Published February 7, 2019 | Last Updated February 28th, 2024 at 04:03 pm

As teenagers, we feel like the future is open to us. The idea of going into debt isn’t scary because the repayment comes years later — and we just figure that we’ll have a good job and be able to pay off the debt.

Chances are, your high school students are looking at things the same way. One of the commenters in our Facebook group asked this question:

“How do I explain $80,000 in student loan debt to my 17-year-old?”

That’s not an easy task. The number is almost too huge to really process. But there are things you can do to help your child understand the huge obligation related to student loan debt — and encourage them to look for other options so they avoid major student loan mistakes.

In most high schools, there’s not much taught in the way of financial literacy. That means it’s on you to explain how student loans work and show them how interest works.

Explain that students borrow to pay for school, and they usually don’t have to pay anything until they graduate. However, once they graduate, they start making payments.

Each loan for each year is a separate debt, however. As a result, they end school with several loan payments to make each month. Plus, they pay different interest rates on each loan.

All of that adds up to actually paying more than you borrowed in the first place. Debt always leads to paying more than you took in the first place because interest is the price you pay for using someone else’s money.

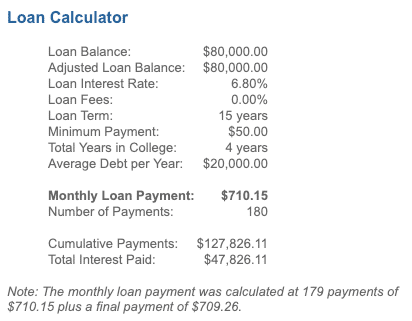

One way to approach this issue, suggested several group members, is to use a student loan calculator. Plug in the numbers so that they can see the realities.

Show your child that because of how student loan interest works, you’re not just paying $80,000 in student loans. What you don’t pay during school is added to your loan — and then you end up paying interest on the accumulated interest as well.

From this calculator, you can see that you’ll pay $47,826.11 in interest. That’s half another college education!

One way to reduce the amount of interest students pay over time is to at least make interest payments during school. You have the option to make minimum payments or interest payments while attending college. If students choose to do this, there is less accrued interest to add to the loan balance after graduation.

However, paying on the principal, when possible, is also beneficial. The principal is the original amount borrowed, so the lower the principal balance, the less interest is charged.

The problem with student loan payments is that interest and fees are taken care of first, and then what’s left goes toward reducing the total amount owed. Let’s say your student loan payments amount to $650 per month. However, your interest amounts to $400 per month.

The first $400 of your payment goes toward the interest. The remaining $240 reduces the principal. With realities like that, it’s not hard to see why it takes, on average, 19.7 years to pay off a bachelor’s degree.

One commenter suggested taking students through the realities of an entry-level salary as well.

You can use websites like PayScale to get an idea of what your student might make in a first job out of college.

For example, the average starting salary for a Class of 2020 college graduate was just over $55,260 a year.

“A good rule of thumb,” wrote the commenter, “they should not take out loans for more than what one year of entry level salary would be.”

Putting that into perspective might also help your student understand that their debt will amount to more money they can make during a whole year of work.

When deciding if a large student loan is worth it, consider how much you can realistically make. Some majors, like STEM majors and medical degrees, can potentially offer a high enough salary to cover the cost. However, humanities degrees — and even some expensive law degrees — won’t yield enough to cover student loan payments.

Even with good careers, though, a word of caution to teens makes sense. “Guess what, my husband with his big school name degree, makes the same as these guys who went to public universities,” says one commenter.

Once you get out into the job world, an expensive school just might not matter. You can still make a good salary even when you attend a less-expensive school.

Finally, talk to your student about what they expect their lives to look like. It’s not easy to get a teenager to look to the future, but it’s possible. Consider showing them your own expenses, so they can see, practically, what is normal for housing, utilities, gas, insurance, groceries, and other costs.

Even looking at the sheer numbers, as many in the Facebook group suggested, might not be enough to impress upon a 17-year-old the realities of making student loan payments.

One commenter suggests letting students practice by paying some of their expenses.

“Start by letting them pay their own gas, cell phone bill for a few months and then explain that’s less than $1,000 per year and have them multiply it by 80,” she writes. “I know my kids cringe when they have to pay for things themselves.”

Letting your kids actually practice can make a big difference. Use the FinAid calculator to get an idea of a monthly payment. In the example above, the monthly payment was $710 for 15 years.

Divide the $50,000 salary by 12 to show your child that they would make $4,167 per month. Go down the list of expenses, including that $710. Show them how quickly the money goes when they have debt.

You can then run through the scenario with a smaller amount of debt, and even use an investment calculator to show them how they could become rich by borrowing less and investing the difference.

It’s hard to help a 17-year-old understand the financial consequences of the decisions they make right now. It’s also important to realize that you’ll probably have to repeat the conversation more than once. My son is 16 and we’ve been having these conversations since he was 12—and he’s only just now starting to really get it.

Keep pushing, though. The more you talk about money, how debt works, and the realities, the more likely your teens are to make better decisions.

To help parents and students make informed decisions about student loan costs, we developed the Road2College Student Loan Comparison Spreadsheet, which is free to download.

_______

Use R2C Insights to help find merit aid and schools that fit the criteria most important to your student. You’ll not only save precious time, but your student will avoid the heartache of applying to schools they aren’t likely to get into or can’t afford to attend.

Other Articles You Might Like:

10 Reasons to Consider Smaller Schools with High Acceptance Rates

12 Assumptions to Avoid When Choosing a College

Colleges With High Acceptance Rates

JOIN ONE OF OUR FACEBOOK GROUPS & CONNECT WITH OTHER PARENTS:

Dear Roadie, My excellent, motivated student wouldn’t let me anywhere near the application process. He insisted he had it handled,...

Dear Roadie, My son will be attending a school that costs $80,000 per year. Am I crazy for wanting him...

After sending four kids to college with a fifth on the way there soon, I’ve learned a thing or two...

At Road2College you’ll find everything you need to make the admissions and paying for college process less stressful and more transparent.

Explore R2C Insights™ — your source for finding affordable colleges and merit scholarships.

Get coaching on admissions and college financing.

Join Road2College where parents and experts work together to inform and inspire college-bound families.

By Grade:

By Stage in the Process:

Ad Policy Disclaimer: Product name, logo, brands, and other trademarks featured or referred to within Road2College are the property of their respective trademark holders. Information obtained via Road2College™ is for educational purposes only. Please consult a licensed financial professional before making any financial decisions. This site may be compensated through third party advertisers. This site is not endorsed or affiliated with the U.S. Department of Education. By visiting Road2College’s site, you accept and agree to be bound by Road2College’s Terms of Use.