Published June 21, 2020 | Last Updated February 28th, 2024 at 04:12 pm

Financial conversations aren’t always easy, but they’re the first step in helping your child achieve their higher-education goals.

Road2College founder Debbie Schwartz, who’s not only a parent navigating college admissions and paying for college, but an expert in personal finance and analysis, says that a family’s financial ability to pay must be an early part of your college planning.

By the time school acceptance letters come in, the family should be prepared to get serious about applying for loans.

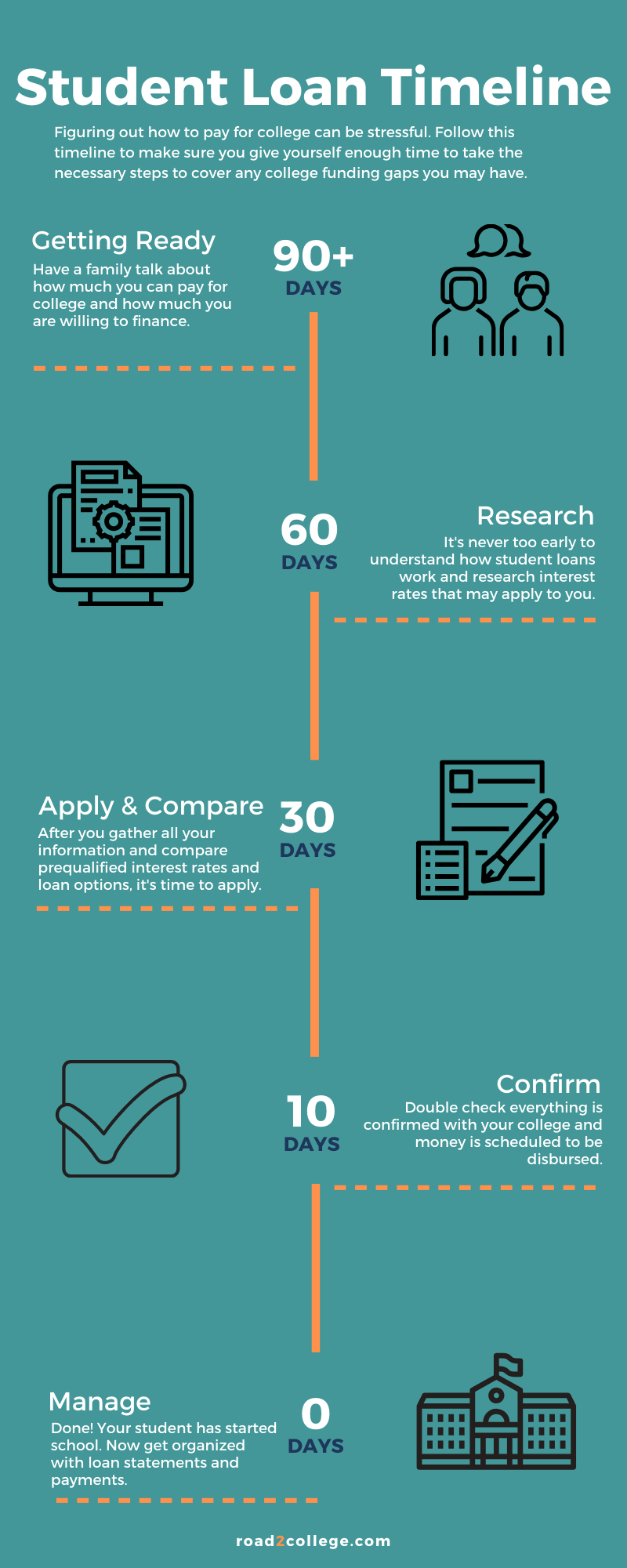

Ms. Schwartz, along with loan experts who were guests on our Facebook Live Three-Day Student Loan series, recently shared the timeline and steps you should follow during the loan research and application process:

Schwartz says that after receiving your college offer letters, and before making your final school choice, families should review finances and be clear on the cost of attending college.

You’ll need to decide what combination of savings and income you’ll use, and how much you’ll have to borrow to make up for any gap.

Experts advise that you take out federal student loans first, then if needed, borrow private or Parent PLUS loans.

Overall, look at college as a four-year budget plan.

In her conversation with Ms. Schwartz, Angela Colatriano of College Ave Student Loans addressed the frequently asked question of when to begin the loan application process.

Her answer? “As soon as you know what you definitely need.”

When shopping for and researching loans, the experts advise you go directly to lender sites.

They have a lot of information about loan types and tools to calculate loan costs and payments.

Although taking out a loan can be intimidating, taking the time to do your research will help you feel more confident about your choices.

Before you apply for a loan, about 60 days from when your first tuition bill is due, explore your loan choices.

The two most important things to compare during the research process are the interest rates and the loan features.

Student lenders advertise a range of fixed and variable rates. Schwartz says that the interest rates offered “will depend on things like your credit score, income, and debt burden. You won’t know what your interest rate is until you apply or ask for a prequalified rate.”

By taking the step of prequalification, you’ll get a better idea of what the rate will be when you decide to apply for the actual loan.

And don’t worry, says Schwartz: “A prequalified rate uses what is known as a soft credit pull, which does not impact your credit score.”

In addition to the interest rate, it’s important to look at the other loan features and how flexible they are, such as:

| Lender | Co-Signer Release | Repayment Options | Term | Interest Rates |

|---|---|---|---|---|

| Yes | – Flat Payment (In-School) – Full (principal & interest) – Deferred – Interest-only | 5, 8, 10, 15 years | 4.07% – 15.48% (Fixed) 5.59% – 16.69% (Variable) Check Rate | |

| Yes | – Deferred – $25 Minimum Amount – In-School Interest Only | 5, 7, 10, 12, 15 years | 4.09% – 15.66% (Fixed) 6.22% – 16.08% (Variable) Check Rate |

|

| Yes | – Pay now or later: Make interest payments – Pay a fixed $25 payment – Defer payments until after school -Undergraduate loan rates displayed. Lower interest rates shown include the auto debit discount. | 10-15 years | 4.50% – 15.49% (Fixed) 6.37% – 16.70% (Variable) Check Rate |

| Yes | – Immediate repayment – Interest-only – Fixed monthly payments in school – Fully deferred | 5, 7, 10, 15 years | 4.44% – 14.70% (Fixed) 5.99% – 14.7% (Variable) Check Rate |

| Yes | – Full payments (Principal and Interest) | 5, 10, 15 years | As low as 4.39% (Fixed) As low as 6.08% (Variable) Check Rate |

|

| – Deferred – $25 Minimum Amount – In-School Interest Only | 5, 7, 10, 12, 15 years | 8.85% – 14.76% (Fixed) 9.25% – 15.18% (Variable) Check Rate |

Melissa Bassett, head of In-School Student Learning at Sofi, says that cosigners can be anyone: “It can be your parent, it can be your aunt, your uncle, your grandparent. It just has to be someone who is creditworthy, which is generally defined as having income, and a debt to income ratio that is acceptable to whatever the lenders range would be.”

This is actually part of the loan features category, but important enough to merit its own section. It means that a cosigner of a loan can be released as cosigner after a designated period of time. Says Schwartz: “Sometimes this information is buried in the fine print. Look for it or call the lender and ask where it is.”

She also notes that requirements for this release vary by lender.

For example: some will release a cosigner after 24 months, others require 36 months, and others may require that a student have a current income equal to at least 50% of the loan balance.

“Make sure you know the requirements,” says Schwartz, “and are comfortable with them.”

Another frequently asked question about student loans is whether the student or the parents should take out a loan.

Schwartz says the answer is easier than you think: “If a student needs to borrow money, they should absolutely take out the Federal Direct Student Loan as their first option.

This loan will be in the student’s name and is usually offered at the best interest rate a student can receive from anywhere.”

Federal student loans are from the government, and thus safe and generally straightforward.

The terms and conditions are set by law with fixed interest rates and a number of repayment plans.

“If additional money is needed beyond this loan,” Schwartz notes that figuring out the name on it may be a “deciding factor in determining whether a family uses the federal Parent PLUS loan or a private student loan.

Parent PLUS loans are only in a parent’s name, so your child has no financial responsibility to pay it back.

For this reason, some families prefer private student loans because they want their child to be financially “on the hook” to pay back loans.

With private student loans, which are made by private firms and lenders such as banks, credit unions, and state-based or state-affiliated organizations, the loan is in the student’s name with a parent (or any other financially responsible adult) as the cosigner.

“It’s very rare that students can get loans without a cosigner,” says Schwartz. “They just don’t have enough credit history or income when they apply.”

Katrina Delgrosso of College Ave explained that for federal loans students should follow application directions from the online portal of the college they’ve chosen.

She says they will likely end up being directed to studentloans.gov (now studentaid.gov).

“It’s best,” she says, “to kind of make a habit of doing it the way that they do it at the school. And then you will be guaranteed not to miss future deadlines.”

For private loans, if possible, apply online since the online approval process is much faster than if you mail it in.

Says Colatriano: “You can apply, and get approved pretty quickly. But then you need to allow two to three weeks between your application and the due date of the money at the school to let all of these pieces come together.”

“Applying for private loans is not difficult,” says Schwartz. Since it’s likely that your student will need a cosigner, have the student and the cosigner fill out the application at the same time.

Ms. Bassett emphasized the importance of a parent and student working in tandem on the loan application: “Make sure you guys are together, or on the phone together.”

Most lenders will ask for basic information from both the student and cosigner. This includes:

“Once approved, you’ll be given specific interest rates for different combinations of payment and loan term options,” Schwartz says.

“This is your chance to decide what payment options you’d like (such as paying interest only while in school, deferring payments until graduation, or paying a fixed amount while in school), along with how long you want to take to pay back the loan.”

After making these choices, the student and cosigner accept the terms of the loan and sign it electronically.

When both the student and cosigner have accepted and signed the loan, the loan needs to be certified with the college the student is attending.

“School certification is a process that involves your school verifying your loan details and making sure it matches their records,” says Schwartz.’

“Schools need to certify the loan amount, your enrollment status, graduation date, and disbursement date.”

According to Ms. Bassett, you can apply for a certain amount, but the lender and the federal government will ask the school if you actually need that amount: “That’s what we call school certification.”

“The money goes to the school. The money does not go to you,” says Bassett. If you’re not eligible, or not eligible for the full amount, the school may reduce the loan amount.

In that case, they will “absolutely” let you know, she says, and adjust the amount.

After certification, lenders will usually notify students.

If you haven’t heard anything after around two weeks, or around 10 days from the day tuition is due, Schwartz suggests that you touch base with your school’s financial aid office for any additional steps the student needs to take such as entrance counseling and completing a master promissory note (only for federal loans), also known as an MPN.

The MPN lasts 10 years. “So you could borrow for multiple years through that one application for the federal direct subsidized and unsubsidized loans on that same MPN,” says Ms. Delgrosso, “but you do have to make a request every year.”

Once your school certifies your student’s loan, they’ll schedule the disbursement date(s) and disbursement amount(s). If you’ve taken out a loan that covers the full academic year, you should be all set. If it covers less than the full year, check with your school for specific instructions about future disbursement requirements and what you need to do to continue your funding.

The good news? By closely following these steps and suggested timeline, you can rest a little easier knowing you’re on top of things, and doing all that you can to give your student the best college opportunities available.

To help parents and students make informed decisions about student loan costs, we developed the Road2College Student Loan Comparison Spreadsheet, which is free to download.

CONNECT WITH OTHER PARENTS FIGURING OUT

HOW TO PAY FOR COLLEGE

JOIN OUR FACEBOOK GROUP

Many families use student loans as the primary way to pay for college. Fortunately, students have various funding options that...

It’s one thing to talk to your child about going to college and perhaps even which colleges they may want...

Parents of high school seniors, I want to share some advice that could save you from heartbreak in the days...

At Road2College you’ll find everything you need to make the admissions and paying for college process less stressful and more transparent.

Explore R2C Insights™ — your source for finding affordable colleges and merit scholarships.

Get coaching on admissions and college financing.

Join Road2College where parents and experts work together to inform and inspire college-bound families.

By Grade:

By Stage in the Process:

Ad Policy Disclaimer: Product name, logo, brands, and other trademarks featured or referred to within Road2College are the property of their respective trademark holders. Information obtained via Road2College™ is for educational purposes only. Please consult a licensed financial professional before making any financial decisions. This site may be compensated through third party advertisers. This site is not endorsed or affiliated with the U.S. Department of Education. By visiting Road2College’s site, you accept and agree to be bound by Road2College’s Terms of Use.