This story was first published in our Paying for College 101 Facebook community. It’s been edited for clarity and flow.

I’m a single mother in California who never went to college, but I’ve worked hard my entire life. I bought a home young. Then my industry—print—collapsed almost overnight. I had a midlife career meltdown while raising a child alone, without a college degree to fall back on.

I started a small business just to survive. During COVID, my mother became severely ill. I became her caretaker, sold her home, moved her across the country, and covered most of her expenses—something I’ve been doing for 25 years.

I care for the generation before me and the one after me.

There has been no financial help. No safety net. Just persistence.

What I did have was a daughter with big goals—and a hard budget limit we couldn’t ignore.

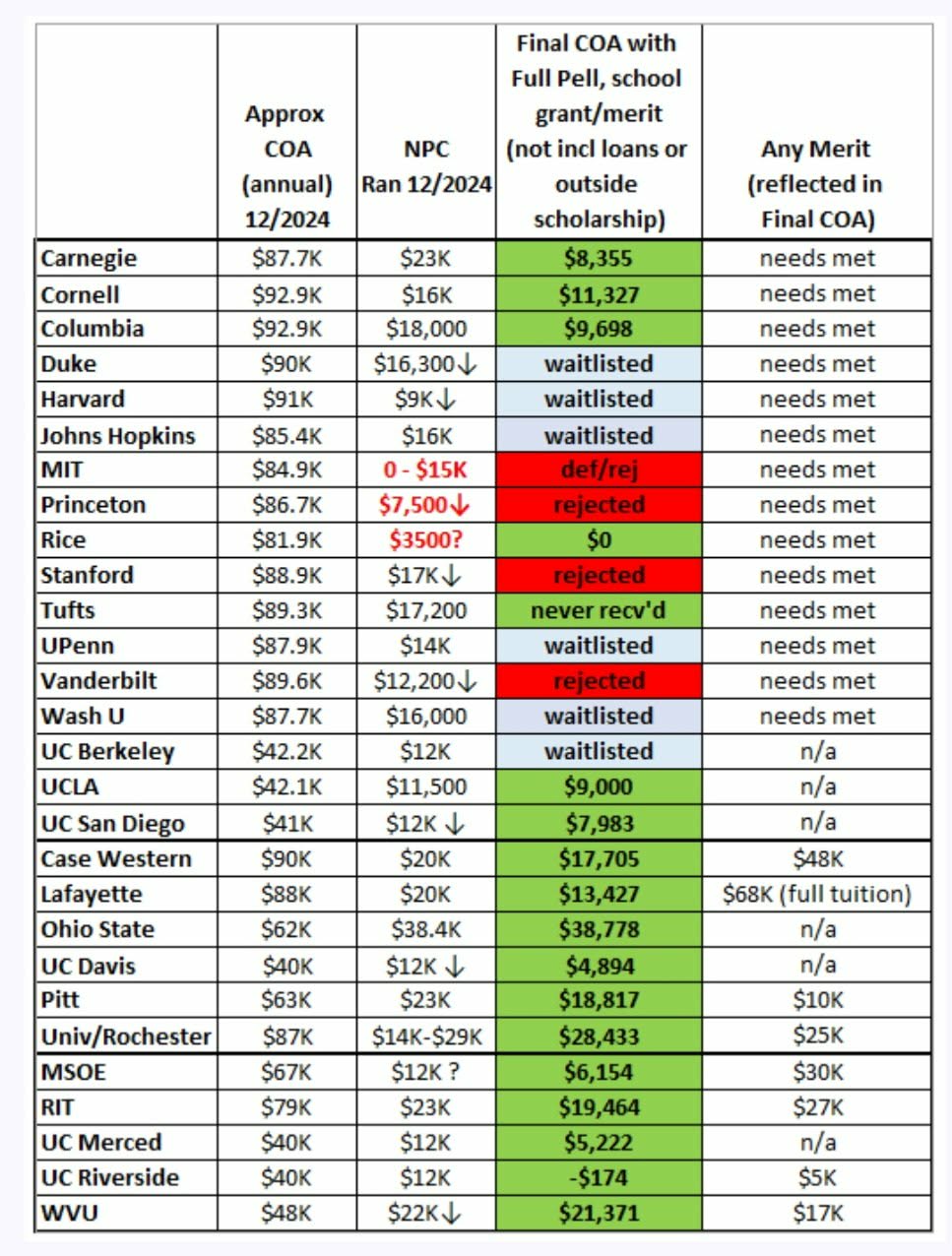

From the beginning, our target was simple but daunting: keep the total cost of attendance under $20,000 per year.

We’re a full Pell household (negative SAI). I’m the only parent. I own a home with high equity—because California—and I have a small rental property that gives me just enough flexibility to survive. On paper, that combination can complicate how some colleges assess financial need—especially schools that weigh home equity heavily. In reality, it meant I had to be strategic.

Casting a Wide Net—Because We Didn’t Know What Was Possible

My daughter applied last year, and we cast a very wide net. Fee waivers made that possible, and uncertainty made it necessary.

Her extracurriculars weren’t perfectly aligned with her intended major—her high school simply didn’t offer much in that area. We worried that would hurt her. At the same time, we knew her academics were strong, and we were laser-focused on schools that met need or offered serious merit.

After running dozens of Net Price Calculators, we started eliminating schools—fast.

Many colleges penalized us heavily for home equity. Schools like Boston University, Boston College, Lehigh, Syracuse, WPI, Drexel, Northwestern, Wesleyan, and others were simply unrealistic once we saw the numbers. In some cases, the NPCs were unclear about Pell eligibility or California grants, but overall, the calculators were remarkably accurate—if anything, they were conservative.

The Stats Were Strong—but That Was Only Part of the Story

On paper, my daughter looked like this:

- GPA: 4.5 weighted / 3.95 unweighted

- SAT: 1530 (780 Math)

- Class Rank: Top 10 out of 522

- Coursework: IB Diploma, 16 AP/IB courses, mostly 4s and 5s

- Honors: Commended PSAT, NHS President

- Leadership: Co-founder of the SWE chapter at her high school

- Service: 200+ volunteer hours

- Commitment: 14 years of ballet

- STEM Exposure: MIT WTP Summer Program (2024) plus earlier STEM programs

- Background: First-generation college student

- Intended Major: Mechanical Engineering, with a minor in Economics or Finance

- Long-term Goal: MBA, likely consulting

She wanted an urban campus, strong STEM, and real connections to finance and consulting.

College Visits Were Our Vacations

We didn’t take traditional vacations.

From freshman year on, every summer meant road trips—mother and daughter—visiting colleges. Over time, we toured more than 30 campuses.

Some places looked great on paper and felt wrong the moment we arrived. Others surprised us. I’m deeply grateful we made those trips, because fit can’t be captured in a brochure—or a rankings list.

Those drives, those conversations, those moments walking across unfamiliar quads—they mattered.

The Choice That Changed Everything

In the end, my daughter chose Columbia University—one of her top choices, alongside MIT and Carnegie Mellon.

She loved the city, the energy, and Columbia’s deep connections to finance and consulting. It felt aligned with who she is and where she wants to go.

Columbia’s original cost of attendance came in around $17,000. We appealed—carefully, respectfully—and they agreed to match Cornell’s offer.

That was the moment it became real.

She also earned $63,000 in outside scholarships, and Columbia worked with us so we could utilize the full amount—something I will always be grateful for, especially given the cost of living and travel in New York City.

At that point, it was a done deal.

Clearing Up the Confusion—Because I Know the Questions

I understand why some people are mystified by how this worked. So here are a few clarifications:

- Under ~$60K AGI, assets are not considered for Pell eligibility.

- A school that doesn’t claim to “meet full need” can still be generous.

- For example, RIT offered a $27K scholarship plus a $25K grant.

- The scholarship is guaranteed (with conditions); the grant is reviewed annually.

- CSS Profile schools were far less concerned about my rental property than many assume.

I was fully honest—with FAFSA, with CSS, with every school.

What I Hope Other Parents Take Away

I didn’t have a college education.

But I learned how the system works—and I used that knowledge to give my daughter options.

Not because I gamed anything.

But because I asked the right questions, ran the numbers, and refused to assume that elite meant unaffordable.

For families willing to do the work, there are paths that make both dreams and budgets possible.

_______

Use R2C Insights to help find merit aid and schools that fit the criteria most important to your student. You’ll not only save precious time, but your student will avoid the heartache of applying to schools they aren’t likely to get into or can’t afford to attend.

Other Articles You Might Like:

How We’ve Afforded College for 5 (Out of 6 Kids) – Without Parent Loans

How Much College Can You Really Afford? Take These 3 Simple Steps for the Answer

How to Make Affordable Colleges Even More Affordable

JOIN ONE OF OUR FACEBOOK GROUPS & CONNECT WITH OTHER PARENTS:

HOW TO FIND MERIT SCHOLARSHIPS