Learning about credit scores and loans is not just for families with students facing a tuition bill in the near future. Knowing this information in advance, will give you time to make improvements to your financial situation if it’s needed.

We’ve all read the headlines… increases in tuition far outpace inflation, tuition rates grow faster than family incomes, and the number of students taking out loans has reached a new high. In the ‘70s and early ‘80s, a college education was somewhat affordable.

If your parents saved then they could probably afford to cover most of the bill. Today over half of all students and families must borrow to afford the ever-growing costs.

We wish we could say this wasn’t the case, but the fact is that students (and families) will be faced with decisions of how to cover what school expects them to and more.

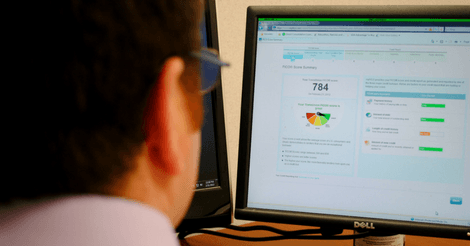

If you are considering a loan of any sort, it’s a must to understand your credit score and how it will impact the loans you can get.

How Does Your Credit Score Affect How Much You and Your Student Can Borrow?

There are two broad categories of loans: loans backed by the government (both federal and state) and private loans secured through a bank, credit union, or other financial entity.

The type of loan your child is applying for determines what specifications must be met, so it is essential to understand the options and factors influencing loan eligibility and interest rates.

Government-backed loans, like the subsidized Stafford loans, do not look at your credit scores. These loans are awarded based on financial need.

Government-backed loans for parents are PLUS loans – Parent Loans for Undergraduate Students. PLUS loans depend on your credit history, not credit score and have a fixed interest rate.

While credit scores are not a factor for approval, a bad credit history that includes any of the following may lead to rejection: foreclosures, bankruptcies, tax liens, wage garnishments, unpaid debts in collection, delinquent on debts for over 90 days, student loan defaults within in the past five years, and having student loans written off as unpayable.

After exhausting all other loan possibilities, students and families may turn to private loans as a final solution for bridging their tuition funding gap. Private loans are highly dependent on your credit score.

In most cases these loans are taken out in the student’s name, but some institutions also provide private loans in the parents names.

Because students have a lack of credit history, institutions urge students to find a co-signer to increase their chances of approval and to receive more favorable interest rates.

Private lenders will also look at credit histories and the student’s income after graduating while determining a student’s loan eligibility and conditions. Co-signers with credit scores from 700-850 should have a very high likelihood of being approved.

Unfortunately, many parents are frustrated to find few options from private lenders if their credit scores are less than 650.

Students can overcome their lack of credit history with a co-signer, but remember, a co-signer is on the hook for making payments if your student fails to. In addition, missed payments will negatively affect a co-signer’s credit history and score. Understand the implications of being a co-signer before you agree.

How Can I Clean Up My Credit Score Fast?

- Take a look at your credit score and dispute any errors (such as inaccurate or outdated information).Get a FREE copy of your credit report from all 3 credit report agencies at www.annualcreditreport.com.

Call 1-877-FACT-ACT (1-877-322-8228) for more information. Spread your requests out over a year, so you are getting one every three months from a different agency. There may be slight variations in your credit score from each agency, because each one tracks slightly differently. - Pay your bills on time, every time; this is simple and very effective in improving your score.

- Avoid charging up to your credit limit – keep debt down to less than 20% of your total limit.

- Join an account, or become a co-signer, of a person with good credit history. Their success will positively impact your score.

- Deferring payments or requesting forbearance of payments will not affect your credit score. Use this strategy sparingly to garner the time needed to make payments.

- Start changing your money habits immediately! It can take up to a year, or more, to see changes to your credit score.

Begin planning for the future by cleaning up your credit score and do it while you have the time, before you or your student may need it!

_______

Use R2C Insights to help find merit aid and schools that fit the criteria most important to your student. You’ll not only save precious time, but your student will avoid the heartache of applying to schools they aren’t likely to get into or can’t afford to attend.

Other Articles You Might Like:

Paying for College With Credit Cards: What You Should Know

Home Equity Line of Credit: What You Need to Know

How to Clean Up Bad Credit If Your Student Needs Student Loans

JOIN ONE OF OUR FACEBOOK GROUPS & CONNECT WITH OTHER PARENTS: