Published February 7, 2019 | Last Updated January 2nd, 2024 at 07:53 am

Financial aid is a complex process, and the acronyms and terms can be confusing. FAFSA, or the Free Application for Federal Student Aid, is a term that is thrown around often.

What is the FAFSA? Do you pay back FAFSA? How do you know what financial aid you have to repay and which is truly “free money?”

These questions and more are answered below. Let’s dive in!

In strict terms, the answer to “Do I have to pay back FAFSA” is no, because FAFSA is not a loan. FASFA is a form you fill out to help determine if you qualify for financial aid, including grants, scholarships and loans. In a nutshell, you don’t have to pay back grants or scholarships, but you do have to repay loans. But there are nuances, as we’ll describe throughout this article.

Next question: How will you find out your financial aid eligibility?

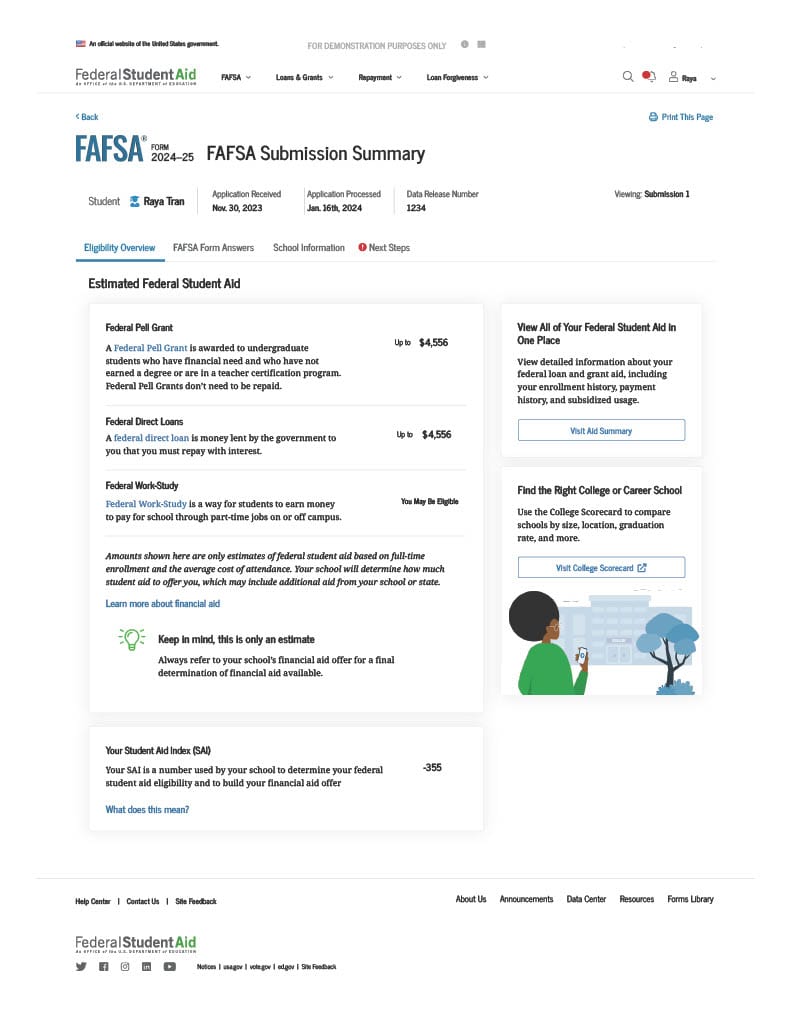

You will receive a FAFSA Submission Summary after you submit the 2024-25 FAFSA, which opened Dec. 31, 2023 in a soft launch. This summary will show your aid eligibility and Student Aid Index, formerly called the Expected Family Contribution (EFC.). This information will help colleges determine what aid they want to offer based on your financial need.

The FAFSA Submission Summary and Student Aid Index are new for the 2024-25 FAFSA, which has been overhauled under the FAFSA Simplification Act. Note that 2023-24 FAFSA (for the current academic year) remains open through June 30, 2024, and still uses the Expected Family Contribution and a document called Student Aid Report, replaced by the FAFSA Submission Summary for 2024-25.

Some of the financial aid that comes through filling out the FAFSA does need to be repaid. Knowing the difference between scholarships, loans, and grants is vital.

This is an example FAFSA Submission Summary from the U.S. Department of Education.

It’s important to understand which type of financial aid you must pay back and which you do not. For example, do you have to pay back scholarships or grants?

The terms grants and scholarships are often used interchangeably. So, if you’re interested in aid you don’t have to pay back, you want to focus on grants, scholarships, and work-study. These types of financial aid do not need to be paid back unless you leave school after you get the funds but before you attend classes.

Student loans, however, do need to be paid back. There are many types of student loans. Federal Subsidized loans don’t accrue interest while you’re in school. Federal Unsubsidized loans do accrue interest during school. Both do not need to be paid back until after you leave school.

Your family may also decide to look into private student loans or parent loans from banks. You’ll want to investigate these carefully to ensure you understand interest rates, fees, and repayment options.

>> Related Articles:

If you’re interested in focusing on money you don’t have to pay back, you may feel like it’s a good idea to pursue a lot of private scholarships. These can range from $100 to a few thousand dollars, and can be highly competitive.

However, keep in mind that at many schools having outside scholarships reduces the financial aid you receive, because it reduces your financial need. Usually schools will reduce the aid you have to pay back first, such as loans.

Sometimes, though, it can impact the grants and scholarships that the school will offer. Be sure to contact the financial aid office of your top choices to learn about their policies before you put a lot of effort into pursuing private scholarships.

Filling out the FAFSA is not a guarantee that you’ll get money from the school. It’s a way for the government to collect financial information to determine how much your family can be expected to pay toward your education.

As a result, don’t think about it as “Do we have to pay back FAFSA.” Instead, focus on the amount of loans, grants, and scholarships that each school offers. Compare the financial aid awards based on how much aid is offered and how much you have to pay back.

One way to minimize your costs and help the answer to “What financial aid do I have to pay back,” be more reasonable is to focus on schools that are generous. Many schools are known to offer a lot of aid in the form of scholarships, grants, and work-study.

Are you curious what schools those would be? Spending hundreds of hours digging up the data is one way to find out. But even then you might miss something.

Instead, check out our R2C Insights tool. We can help you identify the schools that are a good match for you financially, which gives you a great starting point when it comes to affording college.

CONNECT WITH OTHER PARENTS TRYING TO FIGURE OUT

HOW TO PAY FOR COLLEGE

JOIN ONE OF OUR FACEBOOK GROUPS:

College Financial Aid Costs and Stats

If you’re a family that won’t qualify for need-based aid, it’s time to start looking for merit scholarships. What Are...

Colleges use the Free Application for Federal Student Aid (FAFSA) to determine eligibility for financial aid grants and loans. The...

The world of college financial aid is changing rapidly. This is your guide to a key component: the Student Aid...

At Road2College you’ll find everything you need to make the admissions and paying for college process less stressful and more transparent.

Explore R2C Insights™ — your source for finding affordable colleges and merit scholarships.

Get coaching on admissions and college financing.

Join Road2College where parents and experts work together to inform and inspire college-bound families.

By Grade:

By Stage in the Process:

Ad Policy Disclaimer: Product name, logo, brands, and other trademarks featured or referred to within Road2College are the property of their respective trademark holders. Information obtained via Road2College™ is for educational purposes only. Please consult a licensed financial professional before making any financial decisions. This site may be compensated through third party advertisers. This site is not endorsed or affiliated with the U.S. Department of Education. By visiting Road2College’s site, you accept and agree to be bound by Road2College’s Terms of Use.