This updated FAFSA guide for the 2026-27 academic year provides everything you need to complete the FAFSA and maximize your chances of receiving college financial aid. It includes a quick overview of the year’s key updates and a step-by-step walkthrough to help you complete your submission accurately.

Inside This Article:

- How does FAFSA work?

- Step-by-step instructions on filling out the 2026-27 FAFSA

- Who should submit the FAFSA?

- Who all fills out the FAFSA?

FAFSA Changes for the 2026-27 Cycle

The 2026–27 FAFSA is now open and includes several updates that make filing faster and more accurate. Families will see restored asset exclusions, new contributor invite options, instant account verification, and key adjustments to Pell Grant eligibility and income reporting rules:

- Students can now invite parents or spouses by email — no Social Security number or date of birth required.

- New StudentAid.gov accounts linked to an SSN are verified instantly, so families can start and submit right away.

- Family-owned businesses (≤100 employees), farms you live on, and family-owned commercial fishing businesses are no longer counted as reportable assets.

- Pell Grant rules now add any foreign income exclusion to AGI and limit eligibility for students whose Student Aid Index (SAI) is at least twice the maximum Pell amount (with limited exceptions).

- FAFSA uses 2024 tax information (known as the “prior-prior year”), and the federal submission deadline is June 30, 2027, although most families will submit much earlier to meet college or state priority deadlines.

Now that you know what’s new for this year, here’s a quick refresher on how the FAFSA process works and who should complete it.

How Does FAFSA Work?

The Free Application for Federal Student Aid (FAFSA) is the federal form colleges use to determine eligibility for financial aid, including grants, scholarships, work-study programs, and federal student loans. Each year, students and parents share their income and asset information so schools can calculate how much need-based aid the student may qualify for.

After you submit your FAFSA, the Department of Education calculates your Student Aid Index (SAI) and sends the results to the colleges you list on the form. Each college then uses your SAI, along with its own cost of attendance, to build your individual aid offer.

The biggest thing to remember is that the FAFSA is the gateway to many different forms of financial aid, and every student should submit it—whether or not they expect to qualify for need-based help. These aid types include:

- Federal grants (e.g., the Pell Grant)

- Federal work-study programs

- Federal student loans

- State scholarships

- Need-based aid and some merit scholarships from colleges and universities

Ready to get started? Here’s how to prepare for and complete the 2026–27 FAFSA — and how to avoid the most common mistakes.

Instructions on How to Fill Out the 2026-27 FAFSA

Filling out the FAFSA can take less than an hour if you gather everything you need in advance. Here’s how to prepare, what to expect on each screen, and how to avoid common mistakes.

Step 1: Create (or confirm) your StudentAid.gov account

Each contributor — student, parent, or spouse — must have their own StudentAid.gov account before starting the FAFSA. Accounts linked to a Social Security number are verified instantly, so most people can begin the form right away. Contributors without an SSN can still create an account using the alternate identity-verification process. If you already have an account, log in and confirm your StudentAid.gov information is current — especially your email and mailing address. (This is still sometimes called your FSA ID.)

Step 2. Gather Your Information

Before starting, collect these details for both student and parent:

- 2024 tax returns and W-2s (the FAFSA uses prior-prior-year tax data)

- Social Security numbers (if applicable)

- Records of untaxed income, such as child support received or veteran benefits

- Current balances of savings, checking, and investments

- Email address for each contributor

- List of up to 20 colleges to receive your FAFSA data

New for 2026–27: You’ll need only the email of any contributor you plan to invite — the system now sends them a secure code so they can log in separately.

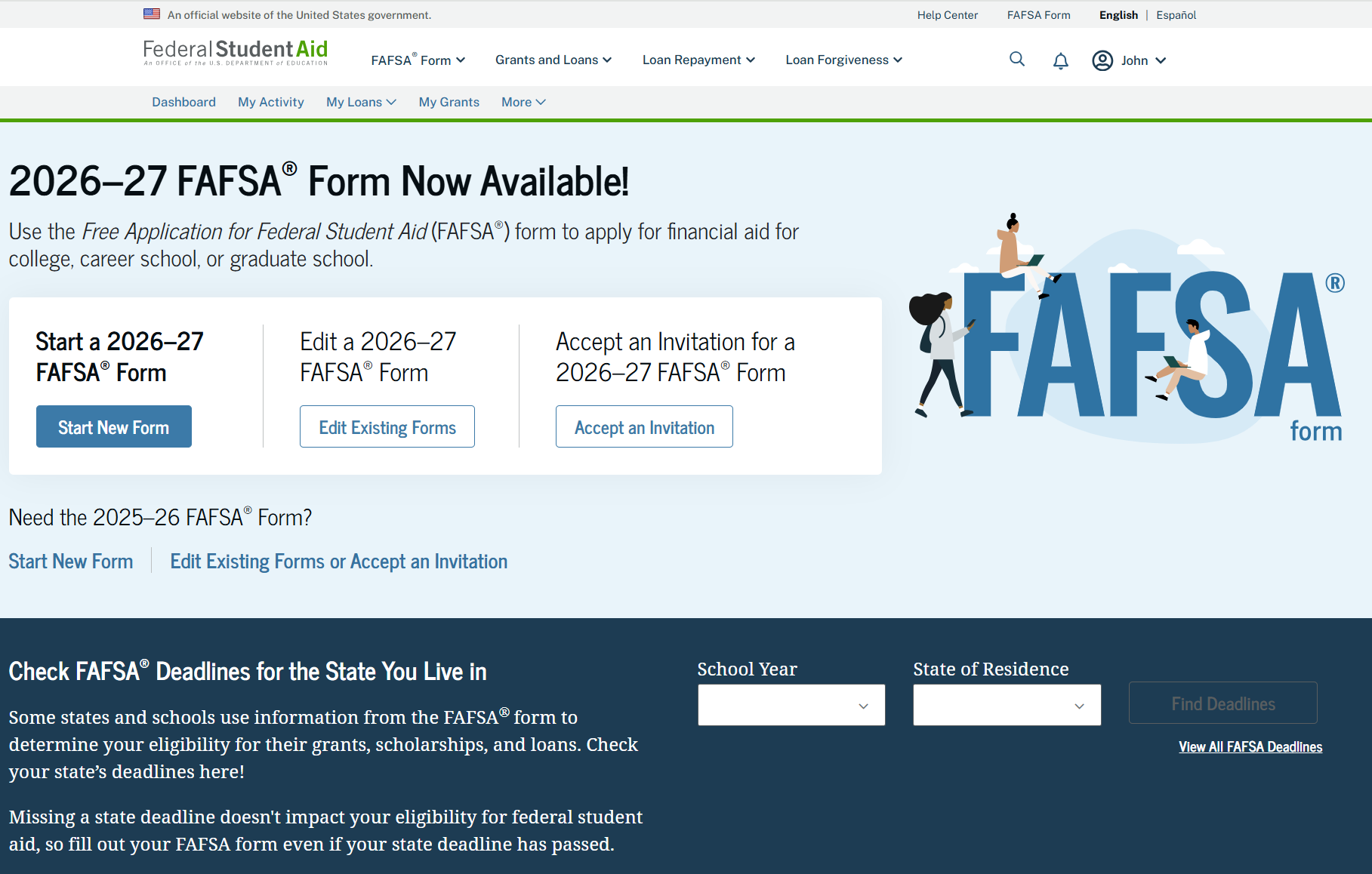

Step 3. Start Your FAFSA

Go to studentaid.gov and select “Start the 2026–27 FAFSA.” The application will ask who you are (student, parent, or preparer) and prompt you to confirm your role.

You’ll then see the new contributor-invite screen. Enter your parent’s or spouse’s email address to send an invitation. The contributor receives a secure code and logs in to complete their portion. All contributors must consent to the IRS Direct Data Exchange (DDX) to pull in tax information automatically.

The application consists of seven sections and up to 36 questions, but some won’t apply to all contributors. You can save the form at any point and return later. The Department of Education estimates the form takes about an hour to complete.

You’ll fill out the following sections if they apply to you:

Personal Identifiers

- Your name, date of birth, Social Security number, and email

- Student (or parent) identity verification

- State of legal residence

- Contributor email address to invite them (the system no longer requires their Social Security number or date of birth)

A parent can log in under their own account to start a student’s form, or vice versa. That triggers an invitation for the other person to log in under their own StudentAid.gov account.

Instructional Materials

Short videos and slides explain the updated FAFSA process and guide you through the new screens.

Consent

All contributors must click the consent button to allow the import of 2024 IRS tax data. The application cannot be processed until everyone gives consent. Each contributor will see this screen at different points in the process.

Student Personal Circumstances

- Marital status

- College plans

- Special family circumstances

- Dependency status

Demographics

- Gender, race, and ethnicity

- Citizenship status

- High school

- Parent marital status

- Parent state of legal residence

Your Finances

Students and parents fill out this section separately. Information from 2024 tax returns will import automatically through the IRS DDX once consent is given. Review all transferred data for accuracy and add current balances for savings, checking, and investments.

New for 2026–27, do not include:

- The net worth of a family-owned business with 100 or fewer full-time employees

- The value of a farm you live on

- The net worth of a family-owned commercial fishing business

Select Colleges

Students can list up to 20 colleges to receive FAFSA information. You can search for each school by name or Federal School Code.

Step 4: Review, Sign and Submit Your FAFSA

Once all required sections are complete, review your FAFSA carefully, then sign and submit.

Each contributor must sign electronically through their own StudentAid.gov account. Once submitted, you’ll see an on-screen confirmation and receive an email within a few minutes.

Accounts linked to an SSN are verified instantly, so most contributors can create an account and submit the FAFSA on the same day.

All contributors must sign before the form is considered complete.

Step 5: Await Your Results Once All Contributors Have Submitted

Your FAFSA is not fully processed until every contributor has signed and submitted their portion. The Department of Education will process your FAFSA after all signatures are received.

If you submitted during the early access or beta period in August or September 2025, your form is valid. The Department will automatically reprocess affected applications; you do not need to resubmit.

Processing times are expected to be shorter this year thanks to automatic IRS data transfer and system stability improvements.

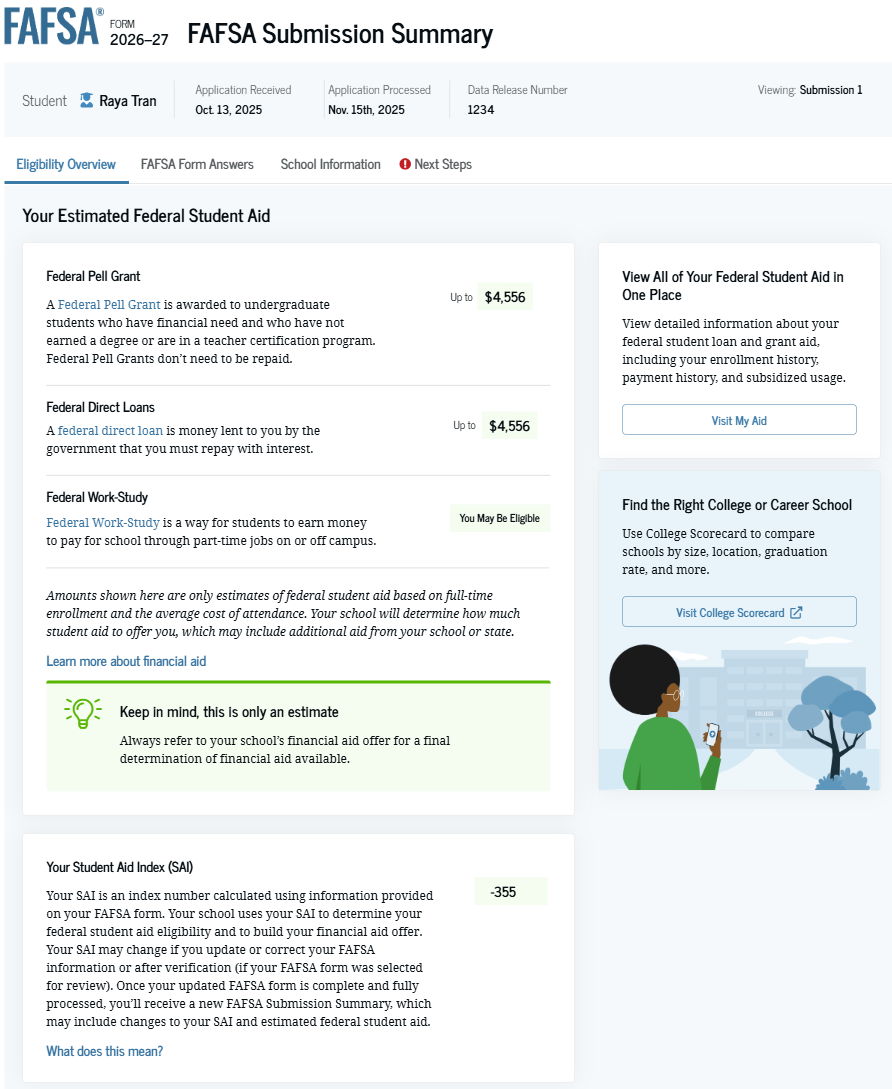

Step 6: Get Your FAFSA Submission Summary

You’ll receive a FAFSA Submission Summary (FSS), which continues to replace the old Student Aid Report. It shows your Student Aid Index (SAI) and estimated aid eligibility.

The SAI can still be a negative number, with a minimum of –1,500, and the number of family members in college is still excluded from the formula.

For 2026–27, the Department of Education adds any foreign income exclusion amount to adjusted gross income (AGI) when determining Pell Grant eligibility. This update may change the aid estimate for some families but does not affect the SAI formula itself.

Your FAFSA Submission Summary includes a link to your online Aid Summary page, where you can review details and confirm the data sent to each college.

Colleges automatically receive your updated Student Aid Index once the Department finishes processing, so you don’t need to send anything separately.

Example screen of the 2026-27 FAFSA Submission Summary from StudentAid.gov.

Get a Sneak Peek at Your Estimated Student Aid

The Department of Education offers a Federal Student Aid Estimator that uses 2024 income information to provide an early estimate of federal grant, work-study, and loan eligibility.

One big caution: this is only a projection based on the information you enter. Your actual aid offer will vary once the FAFSA is processed and your Student Aid Index (SAI) is calculated. Still, the estimator is a good way to get a ballpark figure and plan ahead before completing the FAFSA.

Who Should Apply for FAFSA?

All college applicants should submit the FAFSA, even if their families have million-dollar incomes. Why? FAFSA is the gateway to federal student and parent loans. Second, the calculation for need-based aid may surprise you. Third, FAFSA is used for some state and college scholarships and work-study programs.

“I truly believe everyone should file the FAFSA,” says college planning specialist Luanne Lee. “I’ve had clients that are seven-figure income earners, and we’ve filed the FAFSA for them. You just never know what’s going to happen.”

Bottom line: Fill out the FAFSA even if you think you won’t qualify for need-based aid. Even if you think you can cover every penny alone, having all the options available can’t hurt. And you don’t have to accept any aid you qualify for — it’s your choice.

What happens if you are no longer married to your child’s other parent? The FAFSA process can be a little complicated for divorced parents. Under the rules now in effect, the parent who provides more financial support to the student — not the one the student lives with most — is the parent who must fill out the FAFSA. This rule took effect with the FAFSA Simplification Act and continues for the 2026–27 cycle.

FAFSA Deadlines

The FAFSA for the 2026–27 school year is now open. The federal deadline to submit the form is June 30, 2027, at 11:59 p.m. Central Time.

Most families, however, will want to complete it much earlier to meet state and college priority deadlines, which often fall between December 2025 and April 2026. Submitting early helps maximize eligibility for need-based grants, scholarships, and work-study funds that may be awarded on a first-come, first-served basis.

To find your state’s specific deadline, visit the FAFSA Deadlines page on StudentAid.gov.

Who Fills Out the FAFSA Form?

Each student must complete their own FAFSA, but they may need one or more contributors to provide financial information. A contributor is anyone whose information is required on the FAFSA — typically a parent, stepparent, or spouse.

For dependent students, the parent who provides more financial support is the one who must complete the FAFSA, even if the student lives with the other parent most of the time. If that parent is remarried, the stepparent’s information must also be included.

Students invite contributors by entering their email addresses in the FAFSA form. Each contributor receives an email with a secure code to log in and complete their portion. The contributor’s Social Security number or date of birth is no longer required to connect accounts.

All contributors must create their own StudentAid.gov account and give consent for the IRS Direct Data Exchange (DDX) to transfer their 2024 tax information. The FAFSA cannot be processed until every contributor provides consent and signs electronically.

FAFSA Changes for Divorced Parents

Under the current FAFSA rules, the parent who provides more financial support to the student — not the parent the student lives with most — is the one who must complete the FAFSA. This change, introduced under the FAFSA Simplification Act, continues for the 2026–27 cycle.

Because the higher-income parent often provides the most financial support, this can result in a higher Student Aid Index (SAI) than under prior rules, when the lower-income custodial parent typically filed the FAFSA.

If the parent responsible for filing is remarried, the stepparent’s income and assets must also be included in the FAFSA.

>> RELATED ARTICLE: FAFSA FOR DIVORCED PARENTS

Do You Have to Fill Out FAFSA Every Year?

Yes. Students should complete the FAFSA every year they’re enrolled in college to remain eligible for financial aid, including federal loans, grants, scholarships, and work-study programs. Many colleges also require a current FAFSA to award their own institutional aid.

The federal government calculates financial aid eligibility one academic year at a time, so a new application ensures that updated income or household information is factored into each year’s Student Aid Index (SAI).

Renewing the FAFSA is usually faster than filling out the form the first time, since much of your information can be carried forward and verified through the IRS Direct Data Exchange.

Use Road2College Insights to Find Financial Aid

Road2College offers a college search and comparison tool called Road2College Insights. Try it for free to see which colleges provide the most financial aid for your situation. We offer a free version to get started and a premium version to go deeper.

R2C Insights has data on which colleges require only the FAFSA and which colleges require the FAFSA and the CSS Profile. This information can be helpful for divorced families and families with low income but high retirement assets (since the FAFSA does not include assets in qualified retirement accounts). Insights users can identify schools that only require FAFSA.

Depending on your financial situation, some families should consider having their student apply to at least one or more of these schools.