Applying for financial aid through the Free Application for Federal Student Aid (FAFSA) has become more challenging for divorced parents due to rule changes that took effect last year. These changes affect the FAFSA application process and also have potential tax implications. Let’s explore the changes and their impact on divorced parents.

One important thing to note is that, just like the previous FAFSA rules, the new FAFSA uses information from the “prior, prior” year. This means if you are divorced or separated, you need to start planning two years prior, rather than one year prior to the FAFSA award year. For the 2025-26 academic year FAFSA, parents and students must use 2023 tax return information.

FAFSA Changes for Divorced Parents

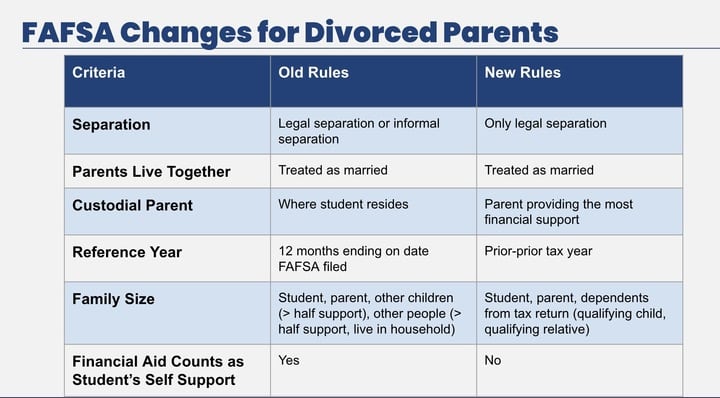

The FAFSA Simplification Act brought about significant changes last cycle, and they remain in effect this cycle for the 2025-26 academic year.

The parent responsible for filing the FAFSA is now determined based on whichever parent provides more financial support to the student, rather than the parent with whom the student resides. As a result, this can cause a higher Student Aid Index (formerly called Expected Family Contribution) than in previous scenarios.

Previously, the custodial parent, usually the one who earned significantly less, would file and report their income and assets on the FAFSA. But now, if the parent who contributes the most financial support has remarried, the income and assets of the step-parent will also be included in the FAFSA.

Here’s a quick summary of the the FAFSA changes for divorced parents that took effect last year:

- The FAFSA form was streamlined, reducing the number of questions from 108 to under 40.

- The Expected Family Contribution (EFC) was replaced by the Student Aid Index (SAI) for need-based program calculations.

- Income information is now directly transferred from the IRS to align the FAFSA with tax return data, making it an automatic process.

- The definition of the custodial parent changed. It’s now the parent who provides the most financial support to the student.

- Family size is calculated based on the number of dependents listed on the parent’s tax return.

- Child support is now reported as an asset, not income.

These changes have the potential to decrease the amount of financial aid available to children of divorced or separated parents. Families may need to reassess custody, support, and tax-dependent arrangements to ensure accurate reporting on the FAFSA.

>>RELATED:

- 2025-26 FAFSA Guide

- Understanding the Student Aid Index: How FAFSA Will Now Use SAI

- Why You Should Fill Out FAFSA Even if You Don’t Qualify for Financial Aid

Determining Your Custodial Parent

The definition of “custodial parent” has changed to the one who provides the most financial support, regardless of with whom the child lives.

According to the new FAFSA rules, the parent who provided the most financial support in the “prior-prior” tax year should complete the FAFSA application instead of the custodial parent. In case of a “tie” in financial support, the ties are broken based on whichever parent has the higher adjusted gross income.

Impact of a Stepparent’s Income and Assets on FAFSA

Many divorced parents wait to remarry until after their student graduates from college. This is because if the custodial parent remarries, the assets, income, and dependents from a stepparent will also need to be reported on the FAFSA.

Potential Tax Implications for Divorced Parents

It is crucial for divorced or separated parents to understand the potential tax implications of the FAFSA changes and how they may impact their financial situation and ability to receive financial aid. Consulting with a tax professional can provide guidance on navigating these changes effectively.

Federal Student Aid, an Office of the U.S. Department of Education, gives specific instructions for providing information about divorced parents on the FAFSA.

The website also says what to do if someone is unable to provide information about both parents due to extenuating circumstances including refusal to participate, incarceration, abusive home environment, or parents who are non-citizens.

FAQs:

Does FAFSA require both parents’ income if divorced?

If parents are divorced or legally separated, FAFSA requires the parent who provides the most financial support to be the parent filling out FAFSA.

FAFSA parent died, do I report my stepparent’s information?

Students with deceased parents may need to submit death certificates or other proof to their college, and the financial aid application process may be emotionally difficult for grieving students.

For the FAFSA, a student should not report their deceased parent’s income.

If the deceased parent was a student’s custodial parent and the student is not financially dependent on the non-custodial parent, the student may be eligible for a dependency override.

What happens if you lie about the custodial parent on FAFSA?

Some schools audit financial aid applications, especially if they have numerous incoming students in need of money to attend college. This increases your risk of getting caught for putting wrong information on your FAFSA.

Lying on a federal document like the FAFSA is a felony and you and your student may be charged with a felony. You, or your student face up to five years in prison and/or a $20,000 fine. This felony charge will follow you or your student for the rest of your lives, hurting your future chances of an education and a job.

Your student will most likely lose any aid money they were offered. If your student received financial aid because of lying on the FAFSA, you must return it.

How to Use R2C Insights to Find Financial Aid

Road2College offers a college search and comparison tool called R2C Insights. Try it for free to see which colleges provide the most financial aid for your situation. We offer a free version to get started and a premium version to go deeper.

Other Articles You Might Like:

You, Your Ex and College Tuition Costs: How Do Divorced Parents Pay for College?

How to Motivate Juniors to Start the College Process

FAFSA Application Ultimate Guide: How to Apply, Steps, Tips, and FAQs

JOIN ONE OF OUR FACEBOOK GROUPS & CONNECT WITH OTHER PARENTS: