The Free Application for Federal Student Aid (FAFSA) for the 2026–27 academic year is now open, bringing another round of updates for families to navigate. One of the most important pieces of the FAFSA is the Student Aid Index (SAI) — the number that colleges use to estimate how much a family can contribute toward the cost of attendance. Understanding how the SAI works, and what’s new this year, can help families plan for college costs and avoid surprises when financial aid offers arrive.

What Is the Student Aid Index?

The Student Aid Index replaced the Expected Family Contribution (EFC) as part of the federal FAFSA Simplification Act. The number represents how much your family is expected to be able to pay for college, based on income, assets, family size, and other information reported on the FAFSA. Colleges use the SAI to determine how much need-based aid a student can receive.

A lower SAI generally indicates higher financial need, while a higher SAI reduces eligibility for need-based grants and subsidized loans. For some families with very low income and assets, the SAI can even be negative — down to a minimum of –$1,500 — signaling the highest level of need recognized under federal aid formulas.

For the 2026–27 FAFSA, families will report financial information from the 2024 tax year. Contributors—students, parents, or spouses—must also give consent for the Department of Education to retrieve tax data through the FUTURE Act Direct Data Exchange (FA-DDX), which replaced the older IRS Data Retrieval Tool. Without consent, the FAFSA cannot be processed for federal aid.

>> RELATED ARTICLES

How SAI Is Calculated

The SAI is based on information from both income and assets, along with family size and the number of dependents. The calculation is complex, but it generally follows these steps:

- The FAFSA collects income information from the 2024 tax year. That includes adjusted gross income, wages, and certain untaxed income.

- Allowances are subtracted from total income to protect a portion of earnings needed for living expenses and taxes.

- Asset values are reported as of the day you file, including cash, savings, checking accounts, and investments. The formula applies a rate to determine how much those assets add to your index number.

- For 2026–27, there are new exclusions: families do not need to report the net worth of a small business with 100 or fewer full-time (or full-time-equivalent) employees, a family farm where the family resides, or a family-owned commercial fishing business.

- The result is the Student Aid Index — a number used by schools to calculate financial need.

Colleges use the SAI together with the school’s cost of attendance to estimate how much need-based aid a student may receive. The basic formula looks like this:

Cost of Attendance – Student Aid Index = Financial Need

What the SAI Means for Your Family

The SAI is not the amount you’ll actually pay for college. It’s a figure colleges use to determine eligibility for aid. If your SAI is lower than the school’s cost of attendance, the difference becomes your “financial need.” That gap is what colleges try to fill with need-based grants, scholarships, loans, and work-study.

If your SAI is high, you may still qualify for merit-based or institutional aid that isn’t tied to financial need. Colleges set their own rules for those awards.

For 2026–27, the formula for the Federal Pell Grant has also changed. Students with an SAI equal to or greater than twice the maximum Pell Grant amount (currently $14,790) will not qualify for Pell. Students whose non-federal scholarships or grants fully cover their cost of attendance will also be ineligible. In addition, the foreign earned income exclusion must now be added back into adjusted gross income when determining Pell eligibility.

Estimating Your SAI With a Calculator

Studentaid.gov offers a Student Aid Index Estimator that lets students and families get a general idea of their SAI before completing the FAFSA. You’ll need to enter information from the following categories:

- Student details: Date of birth, marital status, state of legal residence, and grade level. You’ll also need to provide your tax filing status, adjusted gross income, total assets, and annual child support received.

- Parent information: Dependent students must include their parents’ tax filing status, adjusted gross income, total assets, and annual child support received.

- Spouse information (if applicable): Independent students who are married should include their spouse’s tax filing status, household income, total assets, and annual child support received.

The estimator won’t calculate your exact SAI, but it provides a helpful preview so you can understand roughly how income and assets affect your aid eligibility.

Your FAFSA Submission Summary Will Provide Your SAI

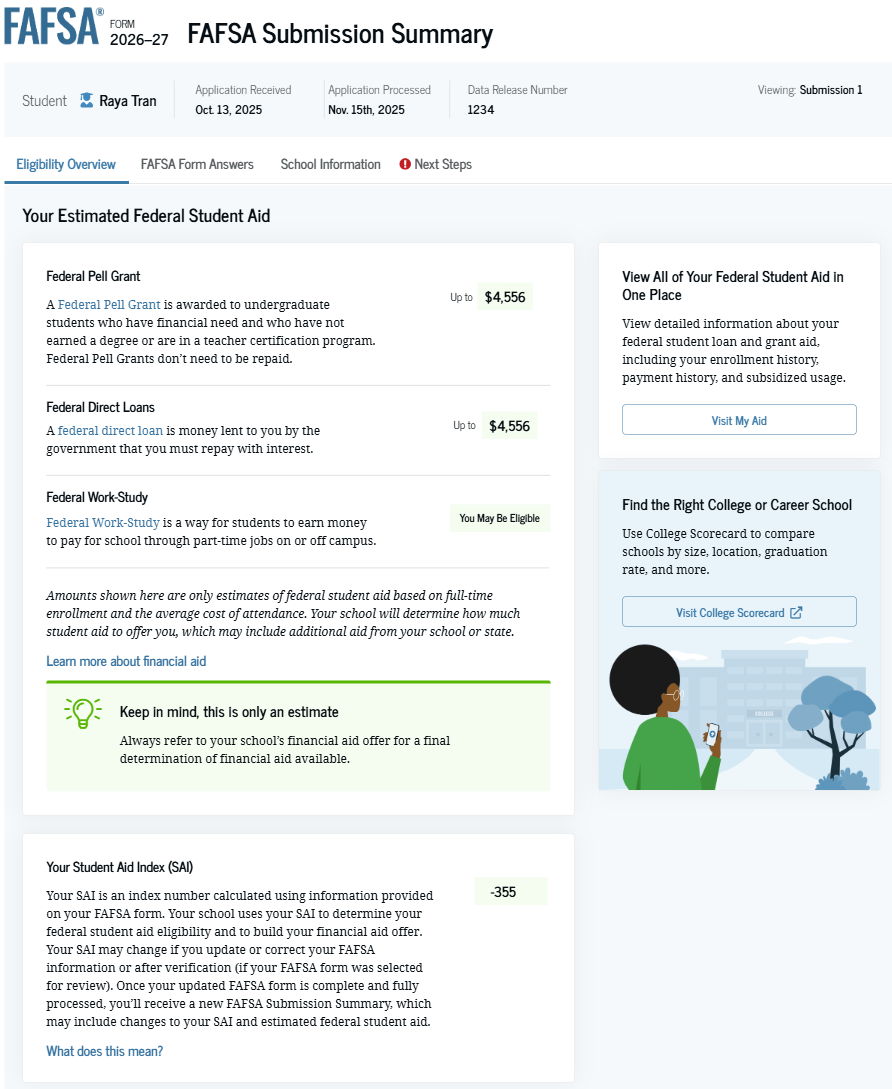

After you submit your FAFSA, you’ll receive a FAFSA Submission Summary from the Department of Education. This replaces the old Student Aid Report (SAR) and confirms that your application has been processed.

The summary includes your calculated Student Aid Index (SAI), an overview of your estimated federal aid eligibility, and a link to a more detailed section called the Aid Summary.

Below is a sample FAFSA Submission Summary from the Department of Education showing where you’ll find your SAI and estimated aid information.

How to Lower Your SAI

The FAFSA formula can’t be changed directly, but understanding how the Student Aid Index is calculated can help you make informed choices about income, savings, and timing.

Your SAI depends mainly on your family’s income, assets, and household information. Lower income and fewer countable assets generally result in a lower SAI, which can increase eligibility for need-based aid.

If your financial situation has changed since your 2024 tax return — for example, due to job loss or medical expenses — contact your college’s financial aid office. Schools can use a process called professional judgment to review your circumstances and, if warranted, adjust your aid offer.

For more detailed strategies on reducing your SAI and planning for future FAFSA years, see our companion article: Strategies to Lower Your Student Aid Index (SAI).

Top 20 Colleges for Merit Aid With SAI Under $30,000

This crowdsourced data shows which colleges have offered the most merit aid to Road2College members so far with an SAI under $30,000. It is for the 2024-25 academic year, and much of it is repeatable in subsequent years.| College | Merit Aid Offers to Members Under $30K SAI | # of Offers | Avg Offer |

|---|---|---|---|

| Susquehanna University | $508,500 | 12 | $42,375 |

| University of Arizona | $418,500 | 18 | $23,250 |

| University of Scranton | $404,000 | 14 | $28,857 |

| University of Alabama | $394,986 | 17 | $23,234 |

| Rensselaer Polytechnic Institute | $392,500 | 11 | $35,682 |

| Rochester Institute of Technology | $369,800 | 14 | $26,414 |

| Wheaton College | $368,400 | 10 | $36,840 |

| University of Vermont | $334,000 | 18 | $18,556 |

| Miami University-Oxford | $330,000 | 21 | $15,714 |

| Ithaca College | $328,300 | 12 | $27,358 |

| University of Dayton | $327,150 | 11 | $29,741 |

| Quinnipiac University | $325,248 | 11 | $29,568 |

| Stonehill College | $324,000 | 9 | $36,000 |

| Hofstra University | $301,500 | 9 | $33,500 |

| Xavier University | $268,682 | 9 | $29,854 |

| University of Hartford | $259,000 | 9 | $28,778 |

| DePaul University | $252,000 | 10 | $25,200 |

| Seton Hall University | $243,500 | 11 | $22,136 |

| Loyola University Chicago | $242,000 | 9 | $26,889 |

| Stevens Institute of Technology | $238,000 | 9 | $26,444 |

Top 20 Colleges for Merit Aid With SAI From $30,000-$60,000

This crowdsourced data shows which colleges have offered the most merit aid to Road2College members so far with an SAI from $30,000 to $60,000 It is for the 2024-25 academic year, and much of it is repeatable in subsequent years.| College | Merit Aid Offers to Members From $30K-60K SAI | # of Offers | Avg Offer |

|---|---|---|---|

| Susquehanna University | $649,000 | 15 | $43,267 |

| Fordham University | $528,835 | 19 | $27,833 |

| Renssalaer Polytechnic Institute | $522,000 | 14 | $37,286 |

| Loyola University Chicago | $480,999 | 19 | $25,316 |

| Case Western Reserve University | $460,000 | 13 | $35,386 |

| University of Arizona | $446,000 | 18 | $24,778 |

| University of Alabama | $443,525 | 21 | $21,120 |

| Loyola University Maryland | $435,500 | 13 | $33,500 |

| Seton Hall University | $434,500 | 17 | $25,550 |

| Miami University-Oxford | $431,000 | 22 | $19,591 |

| University of Hartford | $429,000 | 14 | $30,643 |

| Saint Joseph's University | $422,000 | 14 | $30,143 |

| Drexel University | $394,100 | 13 | $30,315 |

| University of South Carolina-Columbia | $387,006 | 23 | $16,826 |

| Quinnipiac University | $387,000 | 13 | $29,769 |

| Rochester Institute of Technology | $386,500 | 18 | $21,472 |

| DePaul University | $369,000 | 16 | $24,600 |

| University of Scranton | $358,534 | 12 | $29,878 |

| Ursinus College | $339,580 | 10 | $33,958 |

| Hofstra University | $325,500 | 8 | $40,688 |

Top 20 Colleges for Merit Aid With SAI Above $60,000

This crowdsourced data shows which colleges have offered the most merit aid to Road2College members so far with an SAI over $60,000. It is for the 2024-25 academic year, and much of it is repeatable in subsequent years.| College | Merit Aid Offers to Members Above $60K SAI | # of Offers | Avg Offer |

|---|---|---|---|

| Fordham University | $1,138,032 | 41 | $32,147 |

| Rensselaer Polytechnic Institute | $1,085,050 | 29 | $37,416 |

| University of Vermont | $959,500 | 45 | $21,322 |

| Rochester Institute of Technology | $781,650 | 32 | $24,427 |

| Case Western Reserve University | $772,500 | 24 | $32,188 |

| University of Alabama | $765,825 | 32 | $23,932 |

| Drexel University | $727,000 | 31 | $23,462 |

| Fairfield University | $723,500 | 30 | $24,117 |

| Clark University | $701,500 | 24 | $29,229 |

| Quinnipiac University | $699,500 | 24 | $29,146 |

| Worcester Polytechnic Institute | $686,500 | 26 | $26,404 |

| Wheaton College | $681,000 | 16 | $42,463 |

| Loyola University Chicago | $666,500 | 23 | $28,978 |

| Dickinson College | $627,220 | 15 | $41,815 |

| Miami University-Oxford | $602,000 | 32 | $18,813 |

| Seton Hall University | $544,400 | 20 | $27,220 |

| Ithaca College | $543,500 | 19 | $28,605 |

| Loyola University Maryland | $542,500 | 16 | $33,906 |

| Hofstra University | $530,500 | 15 | $35,367 |

| University of South Carolina-Columbia | $501,529 | 28 | $17,912 |

_______

Use R2C Insights to help find merit aid and schools that fit the criteria most important to your student. You’ll not only save precious time, but your student will avoid the heartache of applying to schools they aren’t likely to get into or can’t afford to attend.

Other Articles You Might Like:

2026-27 FAFSA Application Guide

Explaining $80K in Student Loan Debt to a 17-Year-Old

JOIN ONE OF OUR FACEBOOK GROUPS & CONNECT WITH OTHER PARENTS: