Do you have many student loan offers but don’t know how to choose the best one?

Are federal loans always a better choice than private student loans?

Are you struggling to balance monthly payments and the loan term?

Don’t worry; we have the perfect tool for you!

To help parents and students make informed decisions about student loan cost, we developed the Road2College Student Loan Calculator.

Here, we share how to use this simple worksheet and the key factors to consider when comparing student loans!

Key Student Loan Terms You Need to Understand

When comparing student loans, the jargon can be overwhelming.

Loan documents seem like they are intentionally trying to confuse you (and get you to sign your child’s life away).

And the splashy summary pages feel like they aren’t giving you all the information.

Luckily, there are only a few key terms you need to understand to compare loan costs*.

Interest Rate – The amount charged by the lender to you as payment for borrowing.

This is shown as a percentage of the amount borrowed, on an annual basis, but does not include the cost of other fees.

Origination Fee – The fee charged by the lender at the time the loan is created, as the cost of putting the loan in place.

This is how the lender is compensated for processing the loan application, drawing up documents, and initiating the loan.

The origination fee can be expressed in one of two ways: as a percentage of the total loan amount (e.g., 1.50% of $20,000) or a fixed dollar amount (e.g., $350). Federal loans usually charge a percentage, while private loans more frequently use a fixed dollar amount.

Term – The term is simply how long until the loan will be fully paid back, assuming the borrower only makes minimum monthly payments for the life of the loan.

The average student loan term is 10 years, but some loans can extend 15, 20, or even 30 years.

APR or Effective Interest Rate – The APR (Annual Percentage Rate) or “effective interest rate” is similar to the interest rate, but it shows the average annual cost of the loan, including the origination fee and other costs.

This is a better figure to use for comparison than the interest rate.

*Note: These are only the terms you need to understand to compare costs. Those long loan documents do still have important information on payment options and more. Be sure to ask lots of questions before taking out any loan!

How to Compare Your Student Loan Offers Using the Calculator

To help you compare the true cost of your various student loan offers, we created the Road2College Student Loan Comparison Calculator.

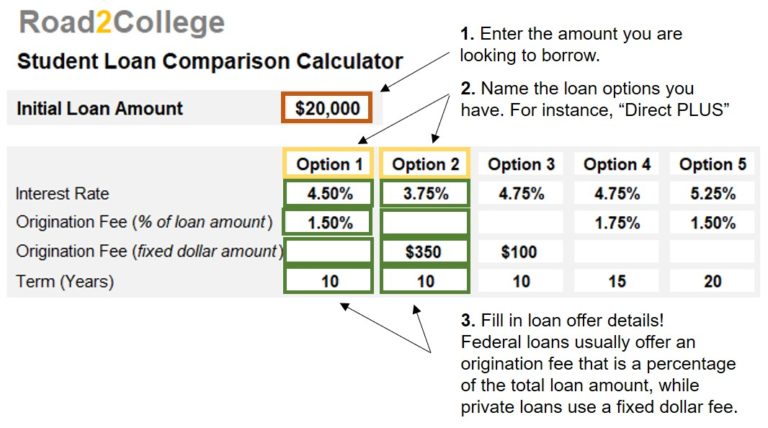

By entering just four easy facts on each of your quotes, you can see your estimated monthly payments, total interest cost, and effective interest rates for every one of your loan offers. Below is an example showing exactly how to use the calculator.

Entering Your Loan Details

The top of the worksheet allows you to enter up to five student loan offers for comparison.

The first step is entering an initial loan amount.

This is the amount you are looking to borrow to cover your college costs.

Next, you want to change the generic loan names (Option 1, Option 2, etc.) to the actual names of the institutions from which you have loan quotes.

For example, enter Direct Plus, Federal Subsidized, and Discover.

This will make it easier to remember which offers are which when you are looking at the loan cost results.

Then, enter the interest rate, origination fee, and term for each of your offers.

These figures should be front and center of any loan offer, and thus pretty easy to find!

However, be sure to enter the origination fee in the right place. Federal student loans (like Direct PLUS) usually offer an origination fee that is a percentage of your loan amount.

Alternatively, private loans typically use a fixed dollar amount. Each loan option should only have fees in one of the two origination lines in the calculator.

And that’s it! Now that your data is entered, you can move on to see the cost comparisons of each loan.

Note: If you have less than five offers you want to compare, you can delete the data in the other cells. Then you will only see the cost comparison for your loans, without the sample results muddying your charts!

Understanding the Calculator Results

Below you can see sample results from the Student Loan Comparison Calculator.

But how can you tell what loan is best for you?

While a lower monthly payment may seem attractive today, it often means a longer loan term and higher interest costs over time.

For example, loan Options 3 and 4 both have 4.75% interest rates.

But loan Option 4 costs almost $3,000 more in interest before being fully paid off.

Finding the right loan requires balancing your ability to make the monthly payments while minimizing the total cost of the loan over time.

If you expect your child to pay off the loan in the future, as many families do, take the time to review the calculator results with them.

It is better that they understand the debt they will face upon graduation now, instead of facing sticker shock in the future!

Federal Versus Private Student Loans

As you compare your student loan offers, be sure to keep in mind which loans are federal and which are loans from private institutions.

Federal student loans, like Direct PLUS loans, are generally cheaper than private options.

Yet, in the cases where they aren’t or where total costs are about equal, don’t forget the additional benefits federal loans offer.

Federal student loans generally don’t start requiring payment until after the student has graduated.

While some private loans require you to start paying right away.

Federal loans can also offer income-driven repayment plans and fixed interest rates.

Private loans tend not to have flexible payment options and may still have variable interest rates.

When costs are comparable, it is generally smart to go with a federal student loan when it is available.

Use Our Student Loan Comparison Calculator to Find the Best Loan for You!

Making sure you won’t end up paying more for college than you need to can be overwhelming. We hope that the Road2College Student Loan Comparison Calculator can help you boil all the jargon down to the most important figures – how much interest you’ll pay and how much you’ll owe every month.

Use the calculator today to discover what is best for your family!

Use R2C Insights to help find merit aid and schools that fit the criteria most important to your student. You’ll not only save precious time, but your student will avoid the heartache of applying to schools they aren’t likely to get into or can’t afford to attend.

👉 Looking for expert help on the road to college? See our Preferred Partner List!

Other Articles You Might Like:

Federal Student Loan Interest Rates

Are Interest-Free Student Loans Available?

Answers to Your Top 5 Questions about Student Loans

JOIN ONE OF OUR FACEBOOK GROUPS & CONNECT WITH OTHER PARENTS: