Published June 10, 2020

Families of high school seniors in our Paying For College 101 Facebook group took our 2020 Did You Get What You Expected? survey about their college admissions experiences and financial aid offers.

The survey was conducted with College Ave Student Loans in April and May of 2020.

Respondents hailed from all over the United States. Here are the results.

Of the over 250 families who responded to our survey, 71% said they were going through the college admissions process for the first time.

Students applied to at least two schools, with the greatest percentage (46%) applying to ten or more, 34% to six to nine, and 20% to two to five.

More than half of our respondents (56%) were not surprised by the admissions decisions their students received. The reasons varied, but some similar themes emerged: they felt they had done an effective job of researching schools before applying; their students (those who were accepted) were well qualified, or they applied to schools they felt were within their reach.

Of those who were surprised by the admissions decisions, most said it was because the outcome was the opposite of what they thought would happen. That is, their student was either waitlisted, deferred, or not accepted when they felt they were strong candidates, or they were accepted or waitlisted to “reach” schools. Here are some additional thoughts shared by respondents:

[It] was my alma mater. [I was] surprised at how much more competitive/selective the school was now. As a minority student, she would have thrived, though.

Not surprised by the decisions, but rather the lack of financial aid.

The school that waitlisted him had recruited him. We expected him to be admitted.

She got into what was considered a reach school that her guidance counselor said she wouldn’t get into.

Students receiving some form of financial aid represented 76% of responders. Of those receiving financial aid, nearly 90% received aid based on merit (up 33% from last year’s survey), and 53% received aid based on need (up 47% from last year’s survey).

Most (79%) of those surveyed said they were either Okay, Satisfied, or Very Satisfied with their financial aid offer. Just over half (54%) chose not to appeal their aid award. Of those who did appeal, 53% received additional money ranging from $1,000 to more than $10,000.

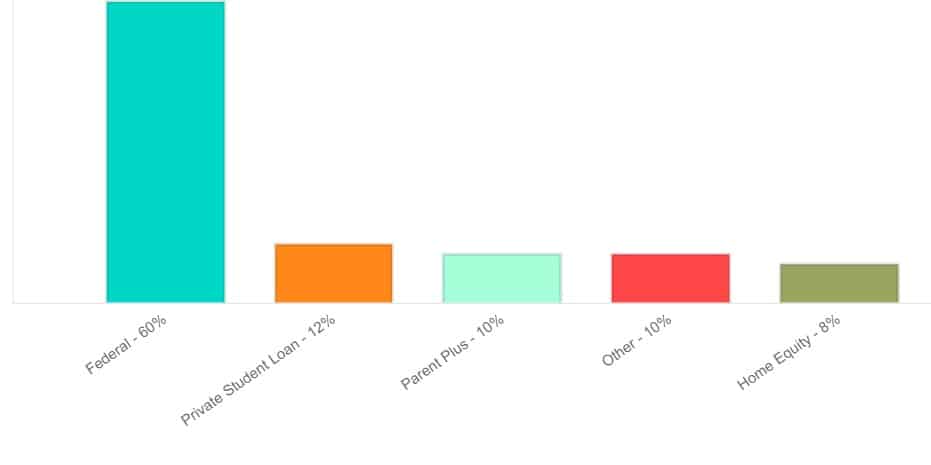

When asked if they had a plan to pay for college, 79% of those surveyed said they do. Nearly 62% say they expect to borrow money, including federal loans (60%), and private student loans (12%), with the remainder of loan types being Parent Plus, home equity, and others.

Emotions ran deep when it came to how families felt about the process of applying to college. The vast majority called it overwhelming, complicated, frustrating, exhausting, or complex. Here are additional, more personal thoughts on the matter from our respondents, including some valuable perspectives for families who’ll be going through this process next year:

It was easy but the pandemic leaves so many questions for the upcoming school year.

It is what it is. Annoying but necessary.

The process itself was not bad, except waiting to hear back from them all. But getting my teenage son to do anything then share the information with us was the hardest part!!

It’s really hard and confusing for kids.

Not so hard if not reaching for the stars.

It was stressful but manageable. I wish I had found your site sooner so as to manage my student’s expectations. In the end she received a package that covers tuition at a school that’s an excellent fit.

Daunting especially with pandemic solutions in place. There is so much uncertainty about when schools will be opening, what type of instruction will be offered and student health. This group has been so helpful in navigating the process with concrete steps to follow and support.

Not bad, as long as you do the research and keep your expectations realistic.

I think there is a lot of hype about getting in. I wish he would have aimed higher and not have been afraid to reach. Rigor didn’t matter nearly as much as we were told.

Wish my son had been more involved earlier on so we had a better plan.

It is extremely important to craft a college list that is realistic and have a realistic plan to pay. Thinking your student will just find outside scholarships to make up a huge gap is NOT realistic!

It requires a ton of research to find schools that are an academic and financial fit. Then you have the third piece — finding the school where your student feels like they could fit in. Then you have the intense stress of applications, waiting for acceptances and financial aid.

In general, I think the process taught my daughter a lot and is a part of the college experience itself.

It’s a long process and in the end, it comes down to SAT scores for higher merit from state schools, and the private colleges will give you more financial assistance.

Money making process! Has no empathy or interest in children at all. Horrible process and needs a revamping.

Interesting! Higher education is a business regardless of the flowery idealism. In an awesome way the process highlighted and augmented our values when it comes to higher education and young adults’ resiliency.

So many of the nuances we stress over with our kids, around both the high school involvements building toward college applications and the college search itself, really end up mattering very little. The current world situation really puts the American college insanity into perspective.

College info needs to be shared more with families with younger children. By high school, it is too late for many strategies.

Admissions was fine for him, but very disappointing in lack of merit aid for a student with 3.9 GPA, with honors, and AP classes and one semester of college credit.

I hired a private college consultant for my son this year, so it made the process super easy. He was awarded a full ride to a prestigious private college in SC.

Was not as bad as we expected but our school was a huge help and gave the students enough time to do it there with the counselors & teachers help.

It was better the second time around with the second child. Also, I learned so much from this group!

We asked families if, because of COVID-19 campuses can’t reopen in the fall, would they be considering any of these alternative college plans for 2020:

Of those who responded, 38% said they are considering other options; nearly 24% are considering attending a school closer to home; around 16% are thinking of taking a gap year, and 14% are considering attending a community college later. In addition, around 5% of students said they are considering reapplying to college, and nearly 3% are considering postponing school indefinitely.

Overall, families are making the best college decisions they can, given the circumstances. With surveys such as this one, parents and students have an opportunity to provide feedback that can hopefully continue to reshape the admissions process and help make it less complicated and less stressful.

We could not have generated this helpful information without our loyal Paying For College 101 Facebook Group. We appreciate that you took the time to share your real-life experiences with others.

Resources

If you have a high school student beginning the college admissions process, we’re here to help. Sign up for our emails to learn more about upcoming Facebook Live discussions with experts in higher ed, as well as find informative articles from our website, college insights, the latest in college news, and our unique college concierge services.

And for families looking for additional funds to cover college costs, check out College Ave Student Loans to learn more about private student loans.

Their tool section, including an easy-to-use student loan calculator, can help families compare loan options and figure out which loan configuration is best for them.

This article was sponsored by College Ave Student Loans.

CONNECT WITH OTHER PARENTS FIGURING OUT HOW TO PAY FOR COLLEGE

JOIN OUR FACEBOOK GROUP

College Financial Aid Costs and Stats

If you’re a family that won’t qualify for need-based aid, it’s time to start looking for merit scholarships. What Are...

Colleges use the Free Application for Federal Student Aid (FAFSA) to determine eligibility for financial aid grants and loans. The...

The world of college financial aid is changing rapidly. This is your guide to a key component: the Student Aid...

At Road2College you’ll find everything you need to make the admissions and paying for college process less stressful and more transparent.

Explore R2C Insights™ — your source for finding affordable colleges and merit scholarships.

Get coaching on admissions and college financing.

Join Road2College where parents and experts work together to inform and inspire college-bound families.

By Grade:

By Stage in the Process:

Ad Policy Disclaimer: Product name, logo, brands, and other trademarks featured or referred to within Road2College are the property of their respective trademark holders. Information obtained via Road2College™ is for educational purposes only. Please consult a licensed financial professional before making any financial decisions. This site may be compensated through third party advertisers. This site is not endorsed or affiliated with the U.S. Department of Education. By visiting Road2College’s site, you accept and agree to be bound by Road2College’s Terms of Use.