Published May 17, 2018

College has become one of the biggest financial decisions a family makes. If you still come up short after researching “free” money to aid in defraying costs, loans can further assist in bridging the gap.

In a Facebook Live, Angela Colatriano, of College Ave Student Loans, helped us sort through the details about federal and private loan options. Here’s what she had to say…

Note: From March 13, 2020, to June 30, 2023, payments on all student loans owned by the federal government have been suspended. In addition, the interest rate on all federal student loans is set to 0%. To help pay off your loans faster, consider making payments during this time. Any payments made between March 13, 2020, and June 30, 2023, will be applied directly to the remaining principal and to any interest already accrued prior to March 13, 2020.

Stafford Student Loans (also known as Direct Federal Loans) – These are loans available to students, strictly in a student’s name.

Unsubsidized Loans: The interest on this loan starts accruing the minute the money “goes out the door to the school,” and it continues to accrue, regardless of whether or not payments are made. These loans are not considered to be need-based (there are basic academic requirements, etc.), so they are open to all students who file FAFSA.

Subsidized Loans: Interest is not charged on these loans during the in-school period but begins accruing only after the student graduates. Subsidized loans are offered to students based on demonstrated financial need.

There are yearly and lifetime maximums for what students can borrow in Direct Federal Loans. Freshmen can qualify for up to $5,500 a year, sophomores up to $6,500 a year, juniors and seniors up to $7,500 each year. (There’s also a lifetime cap, so check out the details on the Dept. of Ed. website.)

Note: Most students are eligible to take out Direct Federal Loans (check the Dept. of Ed. website for more info about Federal Loans), so it is recommended that these loans be considered and used first. Once they have been “tapped out” (because there are limits on their amounts), it is THEN that a student and family may want to consider private loan options.

Federal PLUS Loans (also known as a Parent PLUS Loan) — Undergraduate students cannot obtain this loan directly.

To be eligible, you have to be the parent of a dependent undergraduate, a graduate student, or enrolled in a professional education program. These loans are strictly in a parent’s name. (Students are not responsible for this loan.)

The student must be enrolled at least half-time. The borrower’s credit (the parent) will be reviewed for adverse events, but not specifically for credit score or debt-to-income ratio. If red flags are present, a cosigner may be required. There is no early release for a cosigner on a PLUS loan.

A PLUS loan carries the highest interest rate of any federal loan, although it is still a fixed rate. Effective July 1, 2020, this rate was 5.3%. You can apply by submitting the FAFSA.

A PLUS Loan also has a 4.236% disbursement fee. A disbursement fee (also called an origination fee) is kept by the lender when the loan is sent, meaning that you will only receive 95.7% of what you borrowed. However, you are responsible for repaying the full amount, with interest.

The maximum you can receive for a PLUS loan is the cost of attendance, set by the school, minus any other financial aid received.

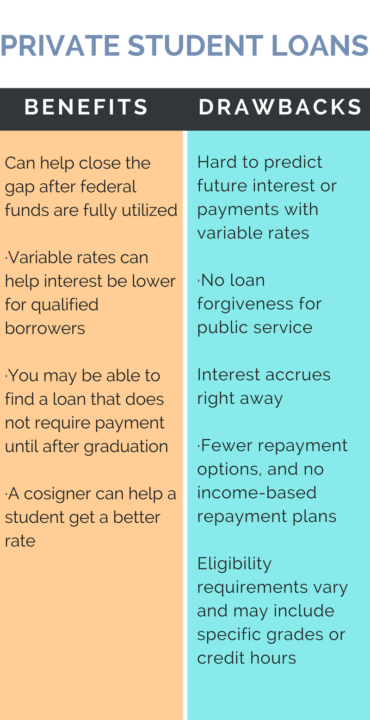

These are loans offered by private lenders, such as a local bank, a national bank, an online lender, or a credit union.

Private Student Loans – Private student loans are in the name of the student, but typically require a cosigner since most students do not have established credit or sufficient income history that could qualify them for a loan.

Cosigners can be a parent or someone else who has invested in that child’s education. A good thing to keep in mind is the lower the “risk” or the better the credit worthiness of the cosigner, the better the loan rate can be.

Note: Angela advises all cosigners to know the details of the lender’s cosigner release criteria. Make sure you ask about this up front when you are researching and comparing loans. (College Ave offers Cosigner Release for their loans, see details below 1.)

Find Out More About College Ave Student Loans

Private Parent Loans – Private Parent Loans are loans strictly in a parent’s name. A student is not responsible for this loan.

Private Parent Loans are similar to the federal Parent PLUS Loan, as both will allow you to borrow up to the full COA (Cost of Attendance), but the Parent PLUS Loan offers a single-fixed rate for everyone, while the interest rate on a Private Parent Loan will be based upon your individual credit worthiness. (College Ave Student Loans impose no Origination Fee on their products.)

Find Out More About College Ave Parent Loans

An origination fee is charged by a lender upon entering into a loan agreement to cover the cost of processing the loan. Federal loans always come with a loan origination fee, while private loans sometimes do not.

College Ave Student Loans does not attach an origination fee onto their loans, but in the case of the Federal Parent PLUS Loans, the origination fee is 4.264%. This addition can heavily impact the TOTAL cost of a Parent PLUS Loan, so it is wise to compare and contrast these loans with Private Loan options. You may, in some cases, get a better rate going the private loan route.

According to Angela, the optimal time to apply for a loan is once you feel confident about the amount you need to borrow. The timing of this may vary, depending on when the college your student is attending sends their tuition bill.

Approval for a private loan can come through rather quickly. After the approval the school has to certify the loan amount according to each student’s cost of attendance. Typically, bills go out at the end of June through the middle of July and due dates are usually 30 to 45 days from that.

This varies for each student. If you do borrow for a full academic year, the lender does not send the entire year’s amount to the school all at once.

The school will generally request only what is needed to cover the current tuition bill. Interest on the loan amount does not start accruing until the loan is disbursed and the interest is based only on the disbursed amount.

The downside of requesting a loan for the full year is if you miscalculate and borrow too little, then need to take out another loan later in the year to cover the remaining amount.

Yes. The profile and pricing on a cosigned loan (with two responsible individuals) will be different from a loan with only one responsible party. It’s a good idea to shop them both and weigh all your options.

It’s good to consider what the repayment terms are on your loan and what choices you have for how many years you have to repay the loan. Questions to ask a potential lender are:

Does the lender assign the repayment terms or do you get to choose?

Will there be prepayment penalties?

Is there a fee for prepaying?

Can you get an interest rate discount if you make automatic debt payments?

Note: Know the factors that affect the costs…the TOTAL cost, the MONTHLY costs, and how you can get to a repayment plan that works within your monthly budget. Some lenders offer interest rate incentives for people who commit to making payments while still in school or for those who choose shorter loan terms. Ask about them.

College Ave Student Loans offers 0.25% interest rate reduction with autopay. The College Ave website offers a calculator that will enable you to see how different scenarios will affect your rate, total cost, and interest charges. It’s a great tool that is available to everyone.

College Ave Student Loans products are structured to encourage choices around repayment. Angela recommends starting to repay the loan as soon as you can, since that is the most direct path to minimizing interest charges.

It will also guarantee you paying the least amount possible for that loan. Lenders offer repayment options: interest only, all at once, upon graduation (as examples), but Angela suggests that even if a deferred repayment option is chosen, don’t hesitate to make even a small contribution as soon as you can.

Private loan companies don’t necessarily have built-in income driven repayment plans and other repayment options that come with some federal loans, but that doesn’t mean your lender won’t try and find a way to work with you to get you back on track successfully.

These options will vary from lender to lender, so call your servicer, and let them know you are in a bind. Act quickly…the situation won’t go away, and may only get worse if you wait.

To get an idea of the interest range you’ll be in, make time between now and when your student’s tuition bill arrives to ask lenders for pre-qualifications. Doing this type of research will help you narrow down lender options.

Know the distinction between monthly payments and the total cost. (Plan for four years.)

Don’t borrow more than what you can expect to make after your first year of college. This is a good way to get your student involved in the decision-making process, and thinking about a career and income for the future.

Watch the full interview with Angela Colatriano here…

This post is sponsored by College Ave Student Loans.

1 College Ave Cosigner Release Requirements: A student borrower who is a U.S. citizen can request the release of their cosigner after more than half of the scheduled Repayment Period has elapsed, if the following requirements are met:

SaveSave

SaveSave

SaveSave

SaveSave

SaveSaveSaveSaveSaveSave

SaveSave

SaveSave

SaveSave

SaveSave

SaveSave

SaveSave

SaveSave

There are two main financial aid forms: the FAFSA, which stands for Free Application for Federal Student Aid, and the...

Nearly 4 million U.S. parents have $111 billion in Parent PLUS loans to help their kids pay for college. That...

Students and parents often must borrow money to help pay college tuition and other educational expenses. However, understanding how student...

At Road2College you’ll find everything you need to make the admissions and paying for college process less stressful and more transparent.

Explore R2C Insights™ — your source for finding affordable colleges and merit scholarships.

Get coaching on admissions and college financing.

Join Road2College where parents and experts work together to inform and inspire college-bound families.

By Grade:

By Stage in the Process:

Ad Policy Disclaimer: Product name, logo, brands, and other trademarks featured or referred to within Road2College are the property of their respective trademark holders. Information obtained via Road2College™ is for educational purposes only. Please consult a licensed financial professional before making any financial decisions. This site may be compensated through third party advertisers. This site is not endorsed or affiliated with the U.S. Department of Education. By visiting Road2College’s site, you accept and agree to be bound by Road2College’s Terms of Use.