Published December 2, 2023 | Last Updated March 28th, 2024 at 04:52 pm

This fully updated 2024-25 FAFSA guide provides the essential information you need to fill out the FAFSA form and successfully apply for college financial aid.

The U.S. Department of Education introduced its revamped FAFSA application process on Dec. 31, 2023. This guide will help you navigate the FAFSA form changes and maximize your chances of making college more affordable.

We will regularly update this guide as more information becomes available.

FAFSA, or the Free Application for Federal Student Aid, is a crucial form for students seeking financial assistance for college. It gathers information about the student’s and family’s finances to determine eligibility for grants, scholarships, and loans. You submit the form annually for each upcoming academic year.

This Road2College guide focuses on the FAFSA for the 2024-25 academic year, which the government unveiled Dec. 31. That’s a three-month delay from the usual Oct. 1 opening date, and it was the government’s rollout deadline under the law. The Department of Education needed the extra time due to all the upcoming FAFSA changes.

Remember that the current FAFSA remains open for the 2023-24 academic year until June 30, 2024, the end of the academic year. Since most people have already submitted for 2023-24, this guide focuses on the 2024-25 FAFSA. (Go to StudentAid.gov if you want the older 2023-24 directions.)

As in previous years, when students and families fill out and submit the completed 2024-25 FAFSA, they’ll learn what types of aid they qualify for – and the portion of college costs their family will be responsible for. Also, note that FAFSA applies not only to colleges and universities but also to career schools and trade schools.

Parents of dependent students are responsible for the Expected Family Contribution (EFC). The government has renamed it the Student Aid Index (SAI) and will calculate the family’s contribution differently, as described later in this article.

The biggest thing to remember is that the FAFSA is the gateway for many different forms of financial aid, and we recommend that every student submit a FAFSA. These different aid types include:

Not all colleges base their scholarships on financial need or ability to pay. Still, they may require you to fill out the FAFSA before awarding merit, athletic, or other talent-based scholarships. Overall, it’s best to ask each prospective college if you should submit the FAFSA for non-need-based scholarships.

Sweeping changes arrived when the new FAFSA process was unveiled on Dec. 31, 2023. This overhaul includes a simplified form, automatic tax data collection, new family contribution calculations, and changes for divorced parents. Remember, this aid is for the 2024-25 academic year starting in fall of 2024.

>> RELATED ARTICLE: Be Prepared for These 10 Key FAFSA Changes When You Fill Out Your Form

Here’s a quick summary of the biggest FAFSA changes:

See our full article on the 10 key FAFSA changes for more details.

All college applicants should submit the FAFSA, even if their families have million-dollar incomes. Why? FAFSA is the gateway to federal student and parent loans. Second, the calculation for need-based aid may surprise you. Third, FAFSA is used for some state and college scholarships and work-study programs.

“I truly believe everyone should file the FAFSA,” says college planning specialist Luanne Lee. “I’ve had clients that are seven-figure income earners, and we’ve filed the FAFSA for them. You just never know what’s going to happen.”

Bottom line: Fill out the FAFSA even if you think you won’t qualify for need-based aid. Even if you think you can cover every penny alone, having all the options available can’t hurt. And you don’t have to accept any aid you qualify for. It’s your choice.

What happens if you are no longer married to your child’s other parent? The FAFSA process can be a little complicated for divorced parents. There’s a change in the upcoming FAFSA cycle year due to the FAFSA Simplification Act. Under the new rules, where the student lives doesn’t determine who should fill out the FAFSA. The parent responsible for filling out the FAFSA is whoever provides more financial support to the child.

We advise submitting the FAFSA as soon as possible because people who file earlier may receive more grant money than later filers. Also, many states and colleges have scholarship deadlines far earlier than the federal deadline, which is each June 30, the end of the academic year.

For example, FAFSA applications for the current academic year, 2023-24, must be submitted by June 30, 2024. However, many state and college financial aid deadlines are much earlier than that. And, as we’ve said, it’s best to file as soon as possible when a new FAFSA cycle opens for the next academic year.

| School | Varies by school, with some as early as January 2024 |

| State | Varies by state, with some as early as January 2024 |

| Federal | June 30, 2025 (end of academic year) |

We recommend reading this guide and other resources to be prepared for the changes and how they may affect your situation.

Some experts advise applicants to wait a week or so after the new FAFSA opens to allow any kinks to be worked out. But don’t wait too long, or you may miss important opportunities for aid.

For example, you can submit early decision (ED) college applications as early as October 1 this year, but as we’ve discussed, the 2024-25 FAFSA won’t open until the end of December. So, we recommend submitting the FAFSA soon after it opens.

Keep in mind many state grants rely on FAFSA. You’ll want to be among the first to apply for first-come, first-served money. Getting the FAFSA filled out right away is the best bet for accessing the most funds.

What happens if you miss the deadline? There’s not much you can do. So make sure to meet the deadline.

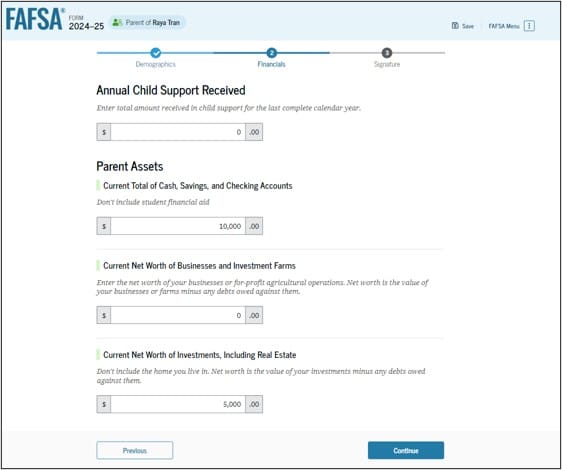

The FAFSA form collects information about a student’s financial background and family situation to determine financial aid eligibility and the family’s expected contribution. Students and their families must input some information manually, but everyone’s tax data will be pulled automatically for the 2024-25 FAFSA, unlike in previous years.

In reality, many parents in past years have filled out the FAFSA for their children. However, both parent and student – and any other “contributors” to the form – will each need a unique Federal Student Aid ID (FSA ID) to sign in to the online portal, access the FAFSA, fill it out, and e-sign it. These “contributors” could include the student, the student’s spouse if married, biological or adoptive parents, or the step-parent (parent’s spouse).

Another option is for students to declare themselves independent, which is very difficult. (Read more about independent student status here.)

The first step in filling out the FAFSA is obtaining an FSA ID, also called a FAFSA ID. Each person who contributes to the form must get one for themselves. You should not create an FSA ID and password for someone else. You’ll need to remember your ID and password for later use.

>> KEY LINK: GET YOUR FAFSA/FSA ID AT STUDENTAID.GOV

Filling out the 2024-35 FAFSA should take less than an hour if you’ve gathered the necessary information. Accuracy remains essential. This section outlines your steps.

Your questions will vary based on what type of FAFSA “contributor” you are. “Contributor” is a new concept for the 2024-25 FAFSA. Contributors can be:

You’ll need to create an FSA ID to access, complete and submit the FAFSA online. It also serves as your signature. Creating the ID before filling out the form can help you avoid any delays later, especially when you’re ready to submit.

To create your ID, go to the FSA ID page at StudentAid.gov.

The parent, student and other contributors must have their own FSA ID. Have your Social Security number, email address and mobile phone number ready.

Based on the government’s prototype, the new application consists of seven sections and up to 36 questions, but some won’t apply to all contributors. Note that you can save the form at any point and return to complete it later. The government estimates the form takes an hour to complete.

You’ll fill out the following sections if they apply to you.

You input identifying information such as:

Note that a parent can log in under their own FSA ID to start a student’s form on their behalf or vice versa. That will trigger an invitation to the other person to log in under their own FSA ID.

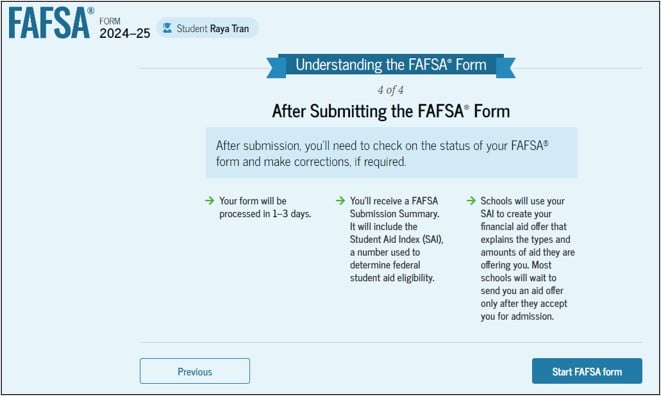

The next screens show a video and slides explaining the new FAFSA process.

All contributors must click the consent button to allow the import of 2022 IRS tax data, or the application won’t be considered. This screen appears at different points for different contributors. But every contributor will get this screen and need to provide consent.

This section asks a series of circumstance questions, including:

You’ll answer questions about:

Students and parents fill this out separately.

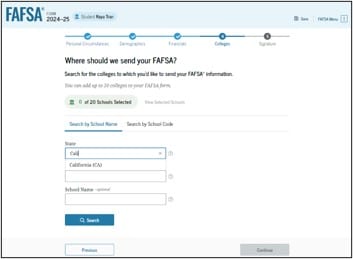

Students can add up to 20 colleges to receive their information. You search for them by name or college code.

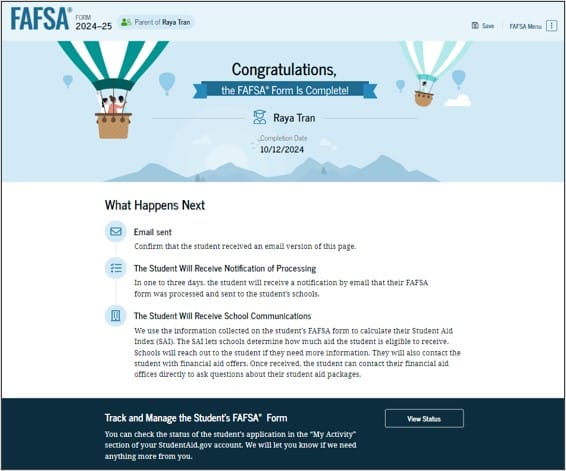

Now you’re ready to review everything, sign and submit your form. You’ll get an email confirming receipt within a few minutes.

Your FAFSA is complete until all contributors have signed and submitted it. The graphic below explains the timing.

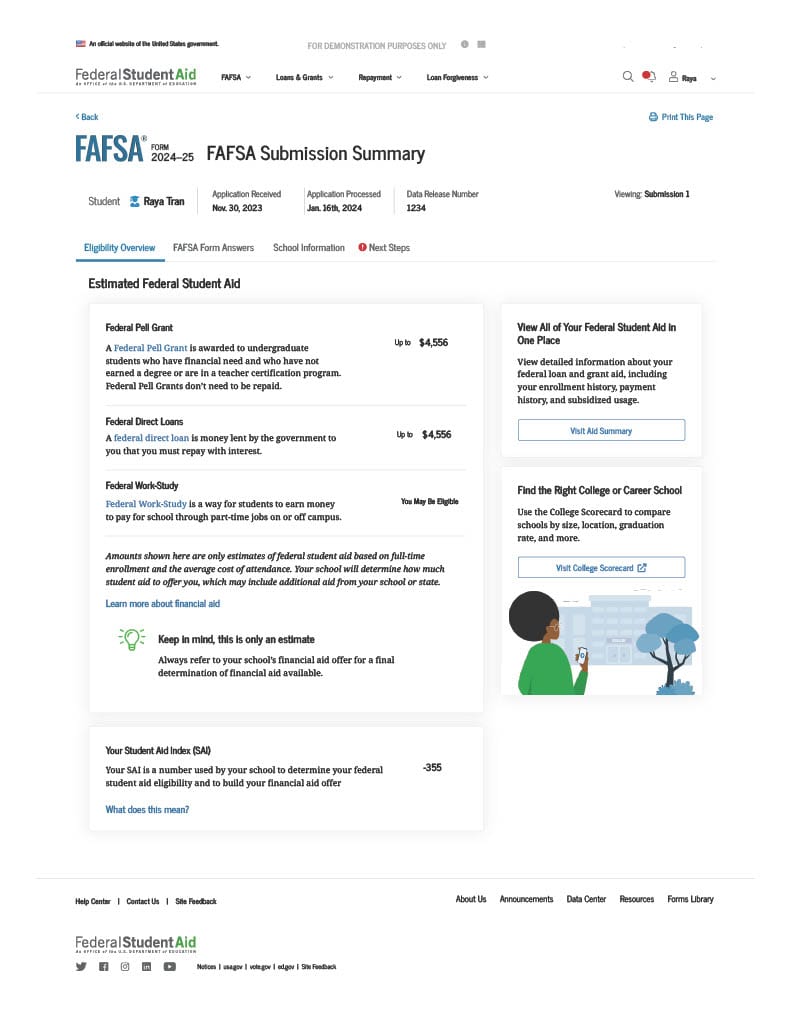

You’ll receive a FAFSA Submission Summary, which replaces the previous Student Aid Report. This shows your estimated aid and Student Aid Index (SAI). The SAI calculation differs from the Expected Family Contribution (EFC), prompting concerns that it may result in higher expected family contributions.

For example, the number of family members in college is no longer part of the calculation. Also, the SAI can now be a negative number, with a minimum SAI of -1,500 instead of zero.

Here’s a sample FAFSA Submission Summary from the Department of Education. It outlines aid eligibility and the SAI and provides a link to a more detailed page, not yet available, called the “Aid Summary.”

The Department of Education offers a Federal Student Aid Estimator. One big caution is that your actual aid will vary from this estimate since it’s based on non-official information. Still, you may want to use it to get a ballpark estimate.

With the new rules, the family’s contribution is based on the higher-income parent. Consequently, this could mean higher expected family contribution (now called Student Aid Index) than most previous scenarios.

That’s because the custodial parent, who may have earned significantly less, used to be the parent to file and report their income and assets on the FAFSA. Additionally, if the parent who contributes the most has remarried, the FAFSA includes the income and assets of the step-parent.

>> RELATED ARTICLE: FAFSA FOR DIVORCED PARENTS

Yes. Students should fill out a FAFSA form each year they’re in college. It ensures their consideration for financial aid (loans and scholarships). It also makes them eligible for certain college-based aid, like special department or athletic scholarships and work-study.

The government calculates eligibility for financial aid one year at a time. Fortunately, renewing the FAFSA is less time-consuming than filling out the initial application.

Road2College offers a college search and comparison tool called R2C Insights. Try it for free to see which colleges provide the most financial aid for your situation. We offer a free version to get started and a premium version to go deeper.

R2C Insights has data on which colleges require only the FAFSA and which colleges require the FAFSA and the CSS Profile. This information can be helpful for divorced families and families with low income but high retirement assets (since the FAFSA does not include assets in qualified retirement accounts). Insights users can identify schools that only require FAFSA.

Depending on your financial situation, some families should consider having their student apply to at least one or more of these schools.

My Student Hasn’t Made Final Decisions on Where to Apply. Can I Still Fill Out my FAFSA?

Your student may not have applied to schools yet, but they should send their FAFSA information to any school they are considering. If you wait until your student has finalized their list, you may miss out on early-round financial aid at the schools they are certain they want to apply to.

The school won’t send you a financial aid offer unless your student is accepted, so don’t be shy. Get your financial information in as soon as you can.

Know if your state requires the schools to be listed in a particular order to get state financial aid. These kinds of details can cost you a lot of money if you miss them!

My Income Is So Different From the IRS Data Being Imported for FAFSA. What Can I Do?

Contact the school to explain your special circumstances. Sometimes the prior-year tax return is not an accurate representation of your finances. If so, you’ll still fill out the FAFSA according to the directions.

However, you can then contact the schools your student focuses on and let them know your special circumstances. They may be able to adjust their financial aid award before they send it out.

What Can We Do if The Aid Award Isn’t Enough?

Families often find that the aid doesn’t meet their full needs. Even if you do have a school meet your student’s full need, you might find that your EFC/SAI is more than you have saved.

If you feel that your student deserves a better award, they may want to appeal the financial aid award. Beyond an appeal, many families turn to private student loans or private parent loans. When you compare lenders, look for specific features. These include various repayment terms, pre-qualification availability, the option to remove a cosigner from a private student loan, a choice of loan duration, and more.

When Should I Start Applying for Financial Aid?

Applying for the FAFSA should begin as soon as the application has opened for the year. (This year it’s Dec. 31, 2023). However, given the upcoming changes, some experts advise waiting a week or two for the government to work out the kinks. Other types of financial aid, such as outside scholarships and grants, can be applied for any time of year that they are available.

Is the FAFSA Form Free?

Yes, the FAFSA is always free.

Is FAFSA Still Accepting Applications for the 2023-24 School Year?

Yes. The deadline for the 2023-2024 year is June 30, 2024, the end of the academic year.

Writer Linsey Knerl contributed to this article.

Dear Roadie, My son will be attending a school that costs $80,000 per year. Am I crazy for wanting him...

After sending four kids to college with a fifth on the way there soon, I’ve learned a thing or two...

Dear Roadie, We are considering moving to New Mexico for my daughter’s final high school years as I’ve read in-state...

At Road2College you’ll find everything you need to make the admissions and paying for college process less stressful and more transparent.

Explore R2C Insights™ — your source for finding affordable colleges and merit scholarships.

Get coaching on admissions and college financing.

Join Road2College where parents and experts work together to inform and inspire college-bound families.

By Grade:

By Stage in the Process:

Ad Policy Disclaimer: Product name, logo, brands, and other trademarks featured or referred to within Road2College are the property of their respective trademark holders. Information obtained via Road2College™ is for educational purposes only. Please consult a licensed financial professional before making any financial decisions. This site may be compensated through third party advertisers. This site is not endorsed or affiliated with the U.S. Department of Education. By visiting Road2College’s site, you accept and agree to be bound by Road2College’s Terms of Use.