Published July 11, 2019 | Last Updated July 30th, 2023 at 10:06 am

We have little set aside in college savings and we almost never qualified for need-based aid. All this puts us squarely in the middle, like a lot of families trying to figure out how to pay for college.

So I’ll share what we did to afford paying for four kids in college at the same time.

I followed the strategies laid out in the Paying For College 101 Facebook group that worked best for our family situation.

Here they are:

If the NPC results are going to be outrageous, don’t even visit, don’t even apply. (Unless there is a compelling reason like an unpublished scholarship your student might get.)

I consider a really safe-safety school to be one where your student’s GPA and test scores are much higher than the college average.

This will make your student one of college’s “top recruits”. Being a “top recruit” makes it more likely that your student would be offered a top merit aid scholarship is at that college.

Be willing to walk away from any college if a better fit (academically, socially, geographically AND financially) comes along. Falling in love with a dream will not make this process more affordable for you nor for your student. It just won’t.

[Read Giving Up Your Dream College To Graduate Debt Free]

Contact admissions and ask what the student needs to show or do to qualify for a higher merit scholarships.

Show a GPA upswing on their interim transcript? Retake the SAT for a higher superscore? Come in for a personal meeting with financial aid officers for possible need aid? Show bank statements? Whatever it takes.

[Read Tips For Handling Your Student’s Financial Aid Appeal]

Especially if it’s a top choice. These are often the same people who sit on the merit or appeals panel, and if they’ve actually met the student in person, the chances of getting approved go up.

Give the college the exact dollar amount that will make your student enroll right then and there.

As long as housing is guaranteed for freshman, have the student follow up via email and periodic phone calls after getting accepted.

But DO NOT COMMIT until literally May 1st to any college you cannot easily afford. Here’s why: if a college happens to be below their enrollment goals, the closer they get to decision day, THEY WILL ALMOST CERTAINLY increase aid offers hoping to get accepted (yet uncommitted) students to enroll.

If you’ve got a high-stats, middle income student, (especially if you’re lower income), DO NOT rule out early decision, restricted early action or single-choice early action (ED, REA or SCEA) at elite, deep-pocketed, need-blind admissions colleges that meet 100% of need with no-loans. Those may actually wind up being your most affordable options!

[Understanding the different types of college admissions deadlines.]

Regardless of their exorbitant sticker prices, heavily endowed colleges often have need aid policies that bring costs down far below your EFC – sometimes free, and often much cheaper than your State college would be. But the catch is they’re almost impossible to get in, no matter how qualified the student is.

To have better than a 1 out of 20 chance of getting in during regular decision, applying in early decision, restricted early decision or single choice early action can open doors to what could actually wind up being your most affordable option!

Just run the net price calculator on a few elite, or Ivy colleges if you’ve got a qualified student and you happen to be middle class – and see what I mean. The ED/REA/SCEA odds are still quite slim – but it can be your best shot.

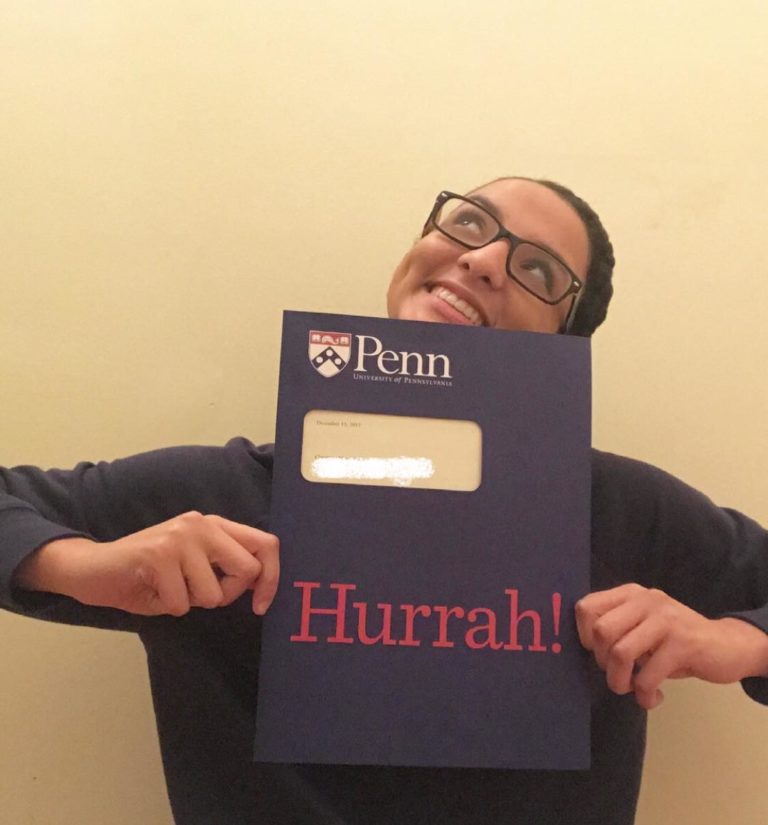

Lastly, I’ve posted pictures, below, of my oldest four kids in their four different colleges along with details on the specific aid and admissions strategies we actually used to get them there. They cover three private colleges and one public school.

For the 2019/2020 school year, we’re able to pay for all four colleges without loans and no college is expecting more money from us than we actually have. (Which IS NOT a whole lot, keeping it real.)

I hope this helps answer questions many of you might have but didn’t feel comfortable asking!

Editor’s Note: Monica Matthews is the author of “How to Win College Scholarships.” She helped her son win over $100,000...

Dear Roadie, My excellent, motivated student wouldn’t let me anywhere near the application process. He insisted he had it handled,...

Dear Roadie, My son will be attending a school that costs $80,000 per year. Am I crazy for wanting him...

At Road2College you’ll find everything you need to make the admissions and paying for college process less stressful and more transparent.

Explore R2C Insights™ — your source for finding affordable colleges and merit scholarships.

Get coaching on admissions and college financing.

Join Road2College where parents and experts work together to inform and inspire college-bound families.

By Grade:

By Stage in the Process:

Ad Policy Disclaimer: Product name, logo, brands, and other trademarks featured or referred to within Road2College are the property of their respective trademark holders. Information obtained via Road2College™ is for educational purposes only. Please consult a licensed financial professional before making any financial decisions. This site may be compensated through third party advertisers. This site is not endorsed or affiliated with the U.S. Department of Education. By visiting Road2College’s site, you accept and agree to be bound by Road2College’s Terms of Use.