Published September 3, 2019

But there are more ways you can save during the college process.

From getting the best deals on textbooks to taking summer classes, and knowing which credits will or will not transfer – these things and more will help ensure your student graduates in 4 years.

Here’s what you need to know about saving money in college…

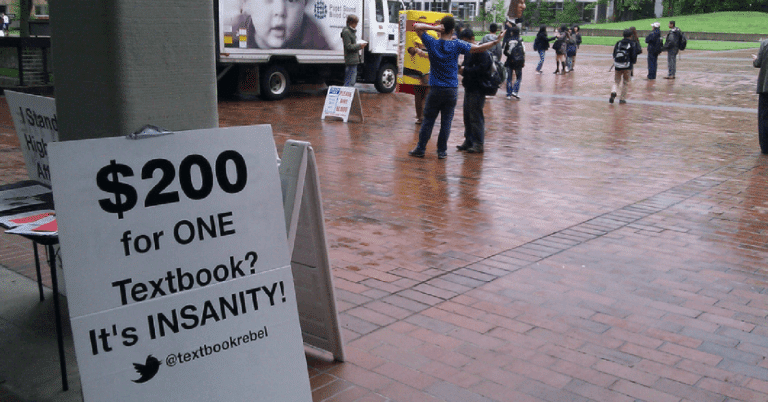

Textbooks are unbelievably expensive, and the professor always requests that you use the newest edition. Fortunately, there are many ways to save money on books.

Don’t be fooled by book buybacks. The only one making money on a book buyback is the bookstore, who buys the book from students for pennies on the dollar and then sells it used for almost as much as the new price.

It’s so important to work with your student to review the suggested course load for the major he or she is considering. Majors like math, medicine, and business can be rigorous and may require a specific focus starting in the freshman year.

You might also want to consider the lifetime earning potential of said major, and if necessary, reevaluate,

If your child is choosing a major that requires a very structured course schedule that must be completed in four years, be sure this is communicated to your student’s advisor up front.

‘The advisor can become an ally in keeping your student on track and encouraging him or her to not drop or withdraw from needed classes.

Almost a third of all college students will transfer to a different school during their college career. There are just some things about the college experience that a student can’t know until they are on campus.

If your child is miserable at school, homesick, or simply changes majors, it can be a good idea for them to change to a more appropriate school.

As a result, it’s important for freshman year and even the sophomore semesters to be filled with general education classes that are easy to transfer.

Electives may be fun, but they don’t do much good in keeping your student on track if they end up needing to transfer. Help your child focus on fulfilling general education requirements first. Remind them that if they finish a dreaded subject, they don’t have to worry about it ever again!

It’s important to remember that you, your student, and your child’s advisor are all on the same team.

The goal is to finish the degree in four years so that you can minimize tuition and your student can launch into their post-college life.

As a result, you may want to check in from time to time.

Due to the Family Educational Rights and Privacy Act (FERPA), the school will not be able to share financial or academic information with you about your child unless your child signs a wavier.

Yes, even if you’re paying for the education!

It’s a good idea to take time during the orientation visit and take your child to the financial aid office and registrar, so that he or she can sign both the financial FERPA waiver and the academic FERPA waiver.

This way, you can have access to your child’s records and contact the school to ask how things are going with their education and budgeting.

You can find out if your student has dropped classes or if they’re charging their student account up too high.

This is a great way to check in if you have a gut feeling something isn’t quite right. However, avoid being the meddling parent who tries to control their child – it will almost certainly backfire

For some students, taking classes over the summer makes sense.

If they have a rigorous major, or if they want to fast-track their education and graduate early, summer sessions can be a great investment.

Unfortunately, some students try to procrastinate on courses they don’t enjoy by assuring their parents that they will take them at a community college in the summer.

There are two concerns here. First, if they don’t want to take math in the fall, they sure won’t want to take it when all their friends are out having fun in the summer!

The second concern is that if the courses are not done at their college, but rather at a community college or other institution, transferring the credits is not always straightforward.

Ask lots of questions during orientation about how to transfer credit from other schools’ summer sessions. Find out if the student needs written permission to complete a class away from campus.

Make sure that your child will get the full credits they need, rather than just getting two credits toward a four-credit requirement!

Asking these questions in advance will save you the hassle and heartache that comes from realizing you paid for a community college course that doesn’t meet the requirements.

Not only are you out the money, your student still has to take the class at his or her college.

When your child is 18 you can’t know what all will transpire during college. However, by taking the steps above, you will save money and be better prepared for changes.

A focus on transferable general credits during the first year or two can make a huge difference if your student doesn’t fit in or enjoy the school and needs to transfer. Saving money on textbooks can save you thousands of dollars. And most of all, graduating in four years saves you and your child money, time, and frustration.

Connect With Other Parents Figuring Out How To Pay For College

Senior year of high school is stressful for everyone — parents, students, and even the admin high school staff. It’s...

Many families use student loans as the primary way to pay for college. Fortunately, students have various funding options that...

It’s one thing to talk to your child about going to college and perhaps even which colleges they may want...

At Road2College you’ll find everything you need to make the admissions and paying for college process less stressful and more transparent.

Explore R2C Insights™ — your source for finding affordable colleges and merit scholarships.

Get coaching on admissions and college financing.

Join Road2College where parents and experts work together to inform and inspire college-bound families.

By Grade:

By Stage in the Process:

Ad Policy Disclaimer: Product name, logo, brands, and other trademarks featured or referred to within Road2College are the property of their respective trademark holders. Information obtained via Road2College™ is for educational purposes only. Please consult a licensed financial professional before making any financial decisions. This site may be compensated through third party advertisers. This site is not endorsed or affiliated with the U.S. Department of Education. By visiting Road2College’s site, you accept and agree to be bound by Road2College’s Terms of Use.